Over the years there have been many discussions about how to increase the rate of effective automated credit decisioning for commercial small-ticket processing. Many financial companies were making progress until 2008, when the credit crisis intervened that resulted in more applications being decisioned by analysts (users) due to changes in cutoffs and rules. In more drastic situations, lenders shut off their models. However, the business imperatives to improve efficiency and reduce costs and, therefore, to move aggressively to a more automated credit underwriting process have not abated, but in fact have grown.

This article will outline one concept to accomplish 100% automated credit underwriting of small-ticket lease credit applications. While this article does not deal with the implementation of this concept, it would make sense that it be applied initially to micro-ticket lease applications to prove the concept, transactions for which there is clearly a business case for not having these applications underwritten by a credit analyst.

This approach is called “Project No Touch,” due to the fact that once the applications are in the system and submitted for credit scoring and decisioning, there is no manual intervention possible. All decisions are rendered instantaneously.

Advantages

In addition to the obvious reductions in cost and improved customer service through 100% instant decisioning, there are several advantages with this approach:

Basic Approach and Key Assumptions

The basic approach is to build a credit process flow that uses three sequential scorecards to process each application. These three scorecards would allow full transparency to credit management as to what is happening to each application at each step in the process. These three scorecards are:

The following are key assumptions under this concept:

Concept Flow

The concept has five main components: PD models/scorecards, decision rules, a review rule scorecard, a cut-off scorecard and a set of five alternative cutoffs per model, all of which are more fully explained below:

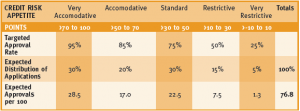

The highest scoring applications would be routed to the most accommodative cut-offs, with a high expected approval rate, and the lowest scoring applications routed to the most restrictive cut-offs with a low expected approval rate. This would be consistent with the preference expounded by most companies, to approve lower risk applications to existing customers from strategic vendors/segments, etc. An example of such a model is shown in Figure 1.

Conclusion

As a result of this process flow, an automated decision of accept or decline is immediately rendered, either by decision rules or cut-offs, for every application submitted. There are no referrals to analysts. This process would also allow credit managers to target both overall approval rates and corresponding risk cost levels. The improvement relates to their ability to target higher approval rates at the same risk cost, or keep approval rates constant and lower risk cost, or a blend of those two approaches. It is recommended that this process be introduced to micro-ticket applications to prove the concept, and fine tune the process, while later increasing the average ticket size of the applications as experience is gained.

Fal de Saint Phalle is VP and manager of Decision Analytics – Region Americas for De Lage Landen, located in Wayne, PA. He joined the company (formerly Tokai Financial Services) in 1996, and since that time has worked in the credit administration area with particular focus on supporting members and vendors with respect to automated credit decisioning, scorecard management, analysis and reporting, as well as predictive model development, validation and monitoring. Prior to this assignment, he spent 24 years at Fidelity and First Fidelity Banks in a variety of commercial credit and lending positions. He holds a Bachelor’s degree from Bowdoin College in (Economics) and a Master’s degree in Business Administration from Columbia University (Finance).

de Saint Phalle is retiring this year after 16 and ½ years with DLL, but is expecting to continue supporting the company on various projects in 2012 and beyond. He intends to remain active in this field. From September 1, he can be reached at [email protected].

No categories available