Allen Qualey President, 1st Source Bank Specialty Finance

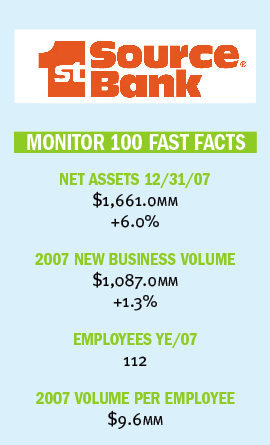

Allen Qualey President, 1st Source Bank Specialty FinanceIn its first year of participation in the Monitor 100, 1st Source Bank Specialty Finance placed at #41 in this year’s ranking, with $1.87 billion in assets. With its focus on seven product specialties, the group’s president, Allen Qualey, sees steady and continuous growth in the years ahead.

1st Source Bank was launched in 1863 as First National Bank of South Bend in Indiana. By 1931, the company became First Bank and Trust Company when its owners Ernest M. Morris and Vincent Bendix merged several banks. Then in the 1980s, the corporation changed its name to 1st Source to “better reflect the diversity of our products and services,” the company’s website states.

According to Qualey, the Morris family, which owned 1st Source, were also the founders of Associates Finance Company. The family remains one the company’s largest shareholders to this day. “It was very likely because of that association between the bank and Associates Finance that our bank got into the specialty finance business,” Qualey explains.

The Specialty Finance division was introduced in 1976 to provide leasing and financing opportunities in a variety of areas nationwide. Today, the group has seven areas of focus including: medium/heavy-duty trucking, auto rental and light-duty trucking, environmental equipment, construction machinery, delivery vans, funeral cars and, the largest, aircraft, which holds a special place in Qualey’s heart.

With a desire to enter the aircraft field, Qualey graduated from Embry-Riddle Aeronautical University with a Bachelor’s degree in Aviation Management. He then went to Middle Tennessee State and earned an M.B.A. in Finance. Along the way he went through a number of flight schools and became certified as a commercial pilot. That affinity for aviation is what led him, eventually, to 1st Source.

Out of school, he started financing aircraft at Cessna Finance, and remained in the field for another ten years working for GE Credit and Commercial Credit. Approximately 21 years ago, he says, 1st Source was looking for someone to start its aircraft product in its specialty finance division, and Qualey was picked for the job. “I was the original aircraft person and for a couple of years, the aircraft division was me.” He started to add others to the team in 1988 and they have grown the segment into what it is today — the largest product within Specialty Finance.

Five years into his tenure at 1st Source, he was named president of the division, which he says was not an easy transition at first. He calls it the kind of dilemma that many face within the industry. “As you move up the hierarchy, you typically have an affinity to one product. Most of the leasing companies today … have product specialists.” All of its originators in the field and division managers are product specific and, “it works much better that way.”

Qualey adds that most who move up the ladder go from being a one-product person to a multi-product person. In his case, 1st Source’s chairman, he says, was very focused on ensuring that Qualey made the transition because “he knew it was going to be a tough one.” Tough but not unattainable, as Qualey was quick to master the intricacies of each product within the Specialty Finance Group.

It is this product specialization that sets the Specialty Finance Group apart from others in the market. First off, 50% of the total company’s loans are made through Specialty Finance. “They are scattered not only through the U.S. but through North and South America and a little bit in Europe,” says Qualey. “Most banks our size would probably have 80-90% of their loans in the local marketplace, certainly their local footprint. That’s one thing that really distinguishes us — that we have a very large commitment to specialty lending.”

As for the group’s goals and initiatives in 2008, and into the next few years, Qualey says, “Our focus is strictly to continue a slow growth between now and 2010. We are not looking for rapid growth; we’re looking for very gradual, quality growth, and we’re being very cautious right now… We’re not trying to capture the world. We just want our piece of it.” Qualey adds that he wants to focus more on the day-to-day aspects of the business, “originating good, quality business, which frankly is challenging enough.”

And in the current economic market, even that is becoming harder to attain. Qualey notes that he doesn’t see, yet, an end in sight for the current credit crisis to turn around. But, he notes, the group’s product lines are indicators of what’s coming, what’s here now and what’s ahead. It’s “interesting how our product line relates to the economy—some products tend to be leading indicators of a recession. Trucking, for example is known to be a leading indicator. When you see tonnage start to drop off, you know the economy is slowing down… Construction machinery, on the other hand, is clearly a lagging indicator and it’s the last product line we have that gets hit with economic issues, so clearly it is the last one to recover,” he explains.

“Finding something that’s really recession proof is very difficult,” he determines, which makes it even more imperative that companies focus more on niche industries and products to stay on top of a downturn. Qualey sees this as a major opportunity for the industry and one that will help some companies keep their heads above water. “There’s great opportunity to develop niches, but it takes time and perseverance.”

For Qualey, the opportunities within the Specialty Finance Group are “in the product we have today… We’ve chosen some solid product lines… We believe in financing hard assets… And we stay very disciplined. And I think that’s the real key; picking your products and staying disciplined with those products.”

But with the opportunities also come the challenges — including getting new blood interested in leasing and financing. “One of the greatest challenges I see … is that there is a dearth of young talent entering the equipment finance industry.” When he started in the industry more than 30 years ago, it wasn’t uncommon to see calling officers in their 20s or 30s. Now, most are graying and ready to retire.

Why hasn’t the industry been able to attract talent like it had two decades ago? Qualey says there’s no easy answer. “Maybe it was because there were too many in it and there weren’t enough opportunities… I also think that 30 years ago, it was easier to find a pathway into the industry. Today, everybody wants to hire seasoned professionals with 20 years experience.”

Yet another reason is the fact that many professionals in the working world today have much less company loyalty than in the past. “Because of that, there’s less of a tendency for companies to want to spend a lot of money training young people because you don’t want to train people for the competitor.”

But for both companies and for younger professionals, it just takes some patience. “I told the young people in my organization — meaning those under 40 — that if they’re patient for a few more years, they’re clearly going to be in a phenomenal position because the next ten years are going to provide a real exodus of seasoned people.”

It’s these ups and downs within and outside of the industry that keep Qualey in the game. “What’s most exciting is that every day is different, unpredictable. Every transaction we’re involved in is different; every company is different and unique.”

No tags available