Now in its thirteenth year, Bank of America’s 2011 CFO Outlook survey occurs at a significant juncture that is telling from a policy and economic management point of view. Coming at the end of the financial crisis, after most regulatory efforts and policy tools have already worked their way into the system, the survey reveals both lingering CFO gloominess regarding the present economy as well as an encouraging and generally positive outlook for 2011 and the years beyond.

Positive Outlook Mirrors Recovery

Overall, the resilience of both manufacturing and services and commodities sectors bodes well for the U.S. economy, and while they share many striking similarities in their outlooks, there are differences, too. Specifically, the outlook for the services and commodities sector is notably less optimistic — unsurprising given manufacturing’s generally tougher time during the financial crisis.

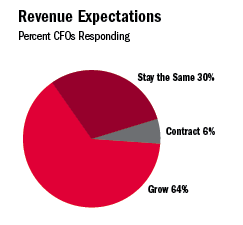

Both sectors — indeed, the majority of U.S. companies — are expecting revenues and profits to grow in 2011 and to hire additional employees, sure signs that America is on the rebound. Other positive indicators include the fact that R&D expenses, capital expenditures and borrowing needs are comparable to pre-recession levels.

U.S. companies are also highly involved in foreign markets and are forecasting growth for international sales in the coming year, though the manufacturing sector is more involved with the global economy and international trade than the services and commodities sector. It is similarly more likely to buy from foreign suppliers, to sell into foreign markets and to establish foreign operations.

The services and commodities sector, in contrast, is more anchored to the U.S. economy and affected by the dynamics that drive it. Likewise, it is less involved in international business, seeking to capitalize by and large on local business opportunities. So U.S. manufacturers are more likely to look overseas for growth and business opportunities, and services and commodities are more likely to look to the U.S. economy for revenue, resulting in extremely positive forecasts for 2011.

On matters of mutual concern, both sectors are apprehensive about the impact of healthcare reform and the U.S. budget deficit, not just for the U.S. economy in general, but their own companies. CFOs are also concerned about the housing market’s lingering effect on the U.S. economy. These issues will continue to cause concern until they show signs of reversal, something for which the CFOs will be watching closely.

Economic Outlook Improving

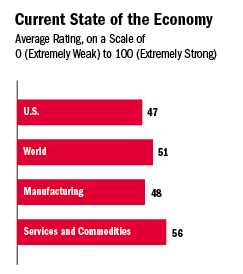

CFOs of U.S. companies still have a negative view of the U.S. economy, giving it an average score of 47 on a scale ranging from 0 (extremely weak) to 100 (extremely strong) — a view consistent among both manufacturers (48) and services and commodities (47). The salient point, however, is that their ratings, though negative, are significantly less negative than earlier in the financial crisis. CFO outlooks are vastly improved over previous years, in other words — and that is good news.

So, too, is their view of the world economy, which is even more positive, receiving an average rating of 51. Consistently, manufacturers rate the present state of the world economy slightly higher (52) than services and commodities (49).

Reiterating the general consensus of the relative strengths of services and commodities versus manufacturing, CFOs give the current state of the U.S. services and commodities sector a positive (56), while the manufacturing sector is viewed more critically (48).

Majority of Companies to Seek Financing

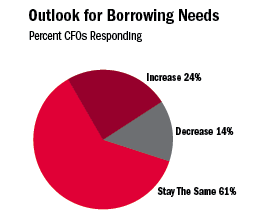

What is the outlook for U.S. companies in terms of borrowing this year? Sixty-one percent of respondents expect their borrowing needs to remain the same compared to 2010, 24% will borrow more and 14% will borrow less. The main reason for cutting back on borrowing? An increase in revenues/profits (say 38%), followed by economic uncertainty (24%), excess capacity (23%), concerns about future taxes and government regulation (22%) and insufficient demand (21%).

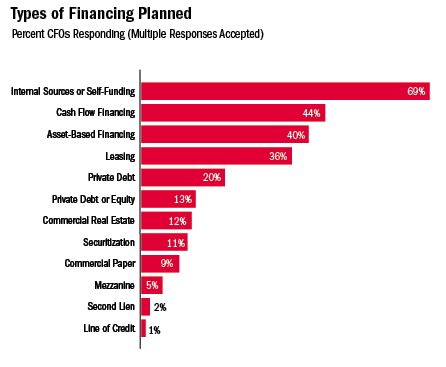

Regardless of industry sector, two-thirds of all U.S. companies will seek financing in 2011, with capital expenditures (38%) and working capital (35%) the two most frequently cited reasons for financing. How will they do it? The majority of CFOs (69%) plan to use internal sources as a means of financing in 2011. Other types of financing that will be used are cash-flow financing (44%), asset-based financing (40%) and leasing (36%).

Compared to a year ago, 55% of respondents see little change in credit availability. Another 28%, though, think their current lenders have either somewhat or significantly increased the credit available to their company — another positive sign of improvement in the U.S. financial system.

Labor Costs and Product Pricing to Rise

When it comes to employment, 47% of companies expect to hire additional employees in 2011, up from 28% of the manufacturing companies that forecast hiring in 2010 (this is the first year we surveyed services and commodities businesses). Only 6% said they expect layoffs, compared with 9% last year.

Of chief concern to those with no plans to hire this year: insufficient demand (61%), concerns about the stability of the economic recovery (45%) and uncertainties about higher health insurance costs (33%). Consistent with those concerns, 58% of U.S. companies predict their labor costs will increase in 2011 and 48% intend to increase the prices of their products. Of these, services and commodities companies (68%) are nearly 20 percentage points more likely to expect rising labor costs in the year ahead than manufacturers (49%) and companies in the Northeast, Midwest and South are more than ten percentage points more likely to predict product price increases than companies in the West.

More Mergers and Acquisitions Planned

Twenty-six percent of all company CFOs expect to participate in a merger or acquisition (M&A) in 2011, a finding that is consistent across both manufacturing (25%) and services and commodities (27%) sectors. Among those companies expecting M&A activity this year, the overwhelming majority (91%) report that they will be making the acquisition, while only 4% say they will be acquired by another company.

Across the board, 55% of CFOs report more businesses available at lower prices than last year, while 27% do not.

International Sales Growth Expected

More than two-thirds (68%) of U.S. companies surveyed have some form of foreign market involvement (85% of manufacturers and 51% of services and commodities). As a whole, 56% buy from foreign markets, 49% sell to foreign markets and 31% have operations in foreign countries.

Looking ahead, projections for international sales growth in 2011 are optimistic with 61% expecting their international sales to increase and both sectors forecasting growth in the identical foreign markets. Where will the action be? In 2011, the top four international markets will be Asia (67%), Latin America (59%), Europe (56%) and Canada (50%).

2011 Outlook:

Optimism and Opportunity

The major findings of the CFO Outlook Study are very encouraging. Despite somewhat dim views of the present economy, there is significant optimism going forward into 2011, an indication that Corporate America is finally getting out of the woods.

Fresh out of a mammoth financial crisis and harrowing recession, the U.S. economy is poised for growth, at least as far as the 801 CFOs surveyed are concerned. With their expectations of better sales, increased revenues and profits in 2011, they’ll also be more likely to increase borrowing — not only to finance their current operations but to increase capital expenditures and fund M&A activity as well.

Here, the CFOs of both manufacturing and services and commodities U.S. companies are united in expecting banks to be attentive to their needs and demonstrate greater flexibility. What they’re looking for, according to respondents, isn’t bankers, but partners. On their wish lists: a willingness to work through tough times by providing integrated banking services and solutions on a more sustainable relationship basis.

No tags available