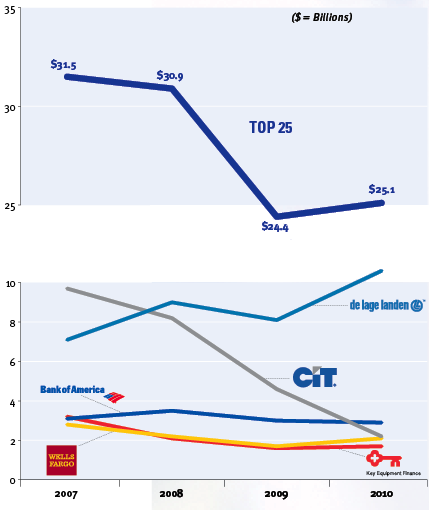

After a difficult year in 2009, most of the Monitor’s top vendor leasing companies came roaring back in 2010 to post better results from their vendor leasing relationships. This becomes more apparent when you consider that CIT’s $2.4 billion year-over-year decline accounted for 77.6% of the aggregate net decline posted by the 11 participants that reported lower new business volume. In other words, when CIT is stripped out of the equation for both years, new vendor originations in 2010 were $22.9 billion, or 15.6% higher than the previous year.

Top 5 Vendor Leasing Companies

This year’s top five origination leaders accounted for $19.5 billion in 2010 new business volume, or 78% of the total reported by the top 25. Notably, De Lage Landen’s 2010 new business volume increase of almost $2.5 billion accounted for over 65% of the overall increase of $3.8 billion posted by the 14 participants that reported year-over-year net increases. With $10.6 billion in 2010 originations, De Lage Landen was, by far, the leader in this line of business and accounted for over 42% of the $25.1 billion total.

Moving up to the #2 spot, Banc of America Leasing at $2.9 billion, although off 3.7% compared to the prior year, easily replaced last year’s #2 ranked CIT that dropped to the #3 spot on a new business volume decline of over 52%. Wells Fargo Equipment Finance’s (WFEF) $2.1 billion, up 19.6% from the previous year, moved up to the #4 slot. It should be noted that WFEF now includes Wells Fargo Financial Leasing, which was consolidated under WFEF in 2010. And rounding out the top five, Key Equipment Finance bounced back from last year’s decline of 23% to swing to a 9.6% increase in the most recent calendar year.

As a footnote to this commentary, we want to acknowledge that one of the major players in the vendor space, GE Capital, was unable to provide us their global vendor leasing activity for the past year.

CIT in Transition

A review of CIT’s vendor finance business over the past four years reveals that its peak was reached in 2007 when the company reported $9.7 billion in vendor new business volume. At the time, CIT enjoyed the benefit of joint venture programs with notable global players such as Dell Financial, Snap-on and Avaya. CIT said in its 2007 annual report, “A significant reduction in origination volume from any of these alliances could have a material impact on our asset and net income levels.” And indeed, over the ensuing two years, that’s exactly what happened.

To put the transition in perspective, at year-end 2010, CIT’s loan and lease portfolio was $36.9 billion compared to $76.9 billion at year-end 2007. In 2007, CIT’s commercial new business volume, including vendor, was $28.8 billion compared to $4.5 billion in 2010. Employee counts at year-end 2007 were 6,700, including 1,845 outside the U.S. versus 3,778 at year-end 2010 (included 1,028 non-U.S.).

Notable Percentage Increases in 2010

PNC Equipment Finance posted the largest percentage increase, reporting a $372.1 million increase, up 56% from the previous year. Marlin Leasing and Bank of the West reported increases of almost 50% and 44.4%, respectively, with Bank of the West moving up into the top ten and Marlin jumping seven slots to end the year at #13. Stearns Bank EF Division’s increase of 42.5% caused it to move up in the rankings to the #18 position while #14 ranked M&I Equipment Finance gained seven slots after posting a 2010 gain in vendor leasing activity of 35.3%. We expect that M&I will show up next year with a new name given the recent announcement that its bank parent will be acquired by BMO Financial.

Notable 2010 Vendor Program Agreements

As shown on page 12 there were a number of notable vendor program agreements in the news over the past six months. De Lage Landen, for example, seems to be on a roll having inked a number of significant programs most notable, in our view, the private label program with Blue Bird and the retail/wholesale program for U.S.- and Canadian-based dealers of construction equipment from Chinese OEM LiuGong Machinery. Also, notable is CIT’s announced extension of its program with Lenovo in Europe and GE Capital’s alliance with Dell and Dell Financial to finance customers for Dell’s channel partners.

No tags available