Assessing the sector opportunities for IT leasing and finance is no trivial task. Information processing and telecommunications technology have become such a pervasive force within so many aspects of our business and personal lives; sometimes, the only reasonable response is to shake your head and quietly mutter, “Where does information technology (IT) begin and end?”

Over the spring break, I took my teenager to an exhibition at the South Street Seaport in New York City. After I paid, the attendant printed out our tickets. At the bottom of the ticket there was a timestamp, five minutes into the future. I commented that their clock was fast. “No, actually, our clock is precisely on time,” the attendant informed me. She explained that the temporary exhibition was so popular the New York City Fire Department required the operators to install “flow-control software” to monitor the total number of people within the 12-room exhibition at any time.

As people moved through and eventually exited, a flow-control system kept track of them. Over the many months of use, it had built up a predictive model of how long people would be in the exhibition. As a result, it could predict how long we would have to wait before we could enter. When we presented our tickets to enter, the projected “people load” was compared with “actual” and we were either admitted or required to wait until an acceptable threshold had been reached. This is but one example of how IT has come to permeate our world.

International Data Corporation (IDC), a worldwide market research firm with more than 900 analysts and offices in 90 countries, provides market intelligence and advisory services for the information technology, telecommunications and consumer technology markets. A major part of what IDC provides for its clients is analysis of what is spent within the many different market segments and forecasts of what will be spent in the future. Many companies use this information to analyze business performance and target future market opportunities.

IT Spending

IDC defines IT spending as spending on “computer” equipment, “prepackaged” software (versus custom-built software by individuals within companies), and the related business services to configure and install the products. In my personal story above, the cost of the computers upon which the software runs, the actual software application (because it was an off-the-shelf product), and the cost to install the system would all be counted as “IT spending.”

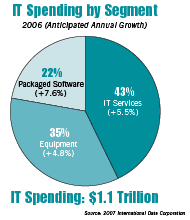

IDC believes the first step in understanding the segment prospects for the IT leasing and financing market is to understand the growth in the underlying markets. In this case, IT spending for the 25 highest spending countries comprised $1.1 trillion in 2006 and accounts for 92% of the total worldwide spending, so this is where we focused our efforts.

Understanding the IT Market Segments

From the perspective of IT leasing and financing providers, the business opportunity related to providing leasing and financing solutions is quite different based on the financing instrument. Of course there are substantial differences between a typical lease that generally includes residual-based pricing and fair-market value purchase options, and financing (e.g., a loan product). Based on IDC’s experience in working with both IT leasing and financing providers and end-user IT organizations, we believe it is difficult to accurately measure how a transaction is recorded (by an end-user) on its financial statements; hence, it is difficult to report an accurate split between leasing and financing instruments.

Those familiar with this segment understand it is possible to have a loan product with a residual position, or a balloon payment. Alternatively, an end-user may aggressively interpret accounting guidelines and categorize what is likely a finance lease as an operating lease. For example, it is not uncommon for some end-user organizations to consider a transaction an operating lease if it has a fair-market value purchase option and the original equipment cost is below $50,000 — photocopier leases are a good example of this. Given these complexities and for the purposes of this report, we will focus on the “IT leasing and financing” market without attempting additional segmentation.

Based on which market segment is addressed — IT services, equipment or software — the opportunities for financing prospects are quite different. Consider the following:

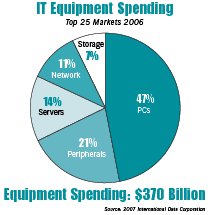

Equipment

Leasing and financing options for IT equipment are rich and varied; the market is mature and competitive. Operating and finance leases are available in the marketplace with a wide range of structures and purchase options. IDC estimates that some 12.5% of all IT equipment sold is leased or financed. Some equipment segments, specifically high-end servers, are leased or financed more than 50% of the time.

Software

IDC categorizes the software market ($240 billion in 2006) into three major segments:

Collectively, these segments will be the fastest-growing components of IT spending, increasing some 7.8% annually through 2010. Financing occurs within all three segments of the market.

Services

That the largest component of IT spending is IT services ($440 billion in 2006) may come as a surprise to some. IDC categorizes the services market in five major segments:

Services in the first two segments — planning and implementation — are where financing activities are generally focused.

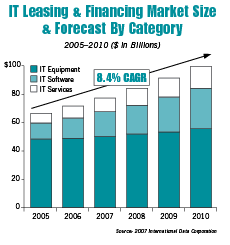

After conducting in-depth analysis of the 25 countries with the largest IT spending (collectively, they account for more than 92% of the worldwide IT spend), IDC concluded the market for IT leasing and financing exceeded $70 billion worldwide in 2006, and will surpass the $100 billion mark by 2010, growing at a compound annual growth rate (CAGR) of more than 8%. (See IT Leasing & Financing Market Size & Forecast by Category.)

Through the forecast period, the industry’s mainstay product, equipment leasing, will come under increasing pressure because of expected changes in accounting treatment, heightened global competition and limited increases in IT equipment spending growth.

The changing market for IT equipment leasing will be overshadowed by strong growth in financing of both IT software and services. In 2006, equipment leasing accounted for approximately 70% of the worldwide leasing and financing volume. By 2010, IDC predicts this share will drop by about 20 percentage points, and software and services financing will comprise approximately 50% of the worldwide market.

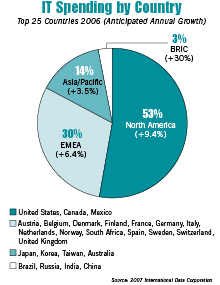

An analysis of the market segmented into regional groupings of the 25 countries with the largest IT spending shows graphically that the market remains focused in the North American and EMEA segments. Nevertheless, the BRIC countries (Brazil, Russia, India and China) are expected to grow more than 30% annually throughout the forecast period. (See IT Spending by Country.)

Accounting Issues; Shift Happens

As a result of IDC’s business model of supporting both providers and end-user IT organizations, we have the opportunity to consult regularly with a wide range of clients. By virtue of this experience, we have a different perspective on the proposed changes to FAS 13, Accounting for Leases. In speaking with IT leasing and financing providers in the U.S., one can readily sense the uncertainty about whether changes will be enacted, and if they are, how these changes might impact their business.

Interestingly, many multinational end-user organizations have concluded that change is going to occur and have already taken steps to adjust their leasing practices based on the presumption that these changes will occur. For them, the accounting changes are not questions of if or even when. When entering into new leasing transactions, many operate under the assumption that lease accounting changes will occur during a 36- or 48-month horizon; therefore, it is prudent and appropriate to assume the change will occur and underwrite the new lease transaction accordingly.

If we examine the robust leasing and financing market in Europe, which already operates on principles-based accounting practices, it is clear the accounting changes have shifted the leasing/financing product mix to one more skewed to financing.

For IT leasing and financing providers looking to the U.S. market, this forecast suggests further substitution of leasing-based financing instruments with financing based structures — unfortunately, with the inherently lower average profitability.

Emerging Technology Changes Will Create New Challenges

In prior forecasts, we mentioned that virtualization technology from companies such as HP, IBM and VMware would affect servers and storage equipment during the forecast period. For IT leasing and financing providers, there are other implications.

IDC believes the new systems management and virtualization software will streamline end-user processes for provisioning and de-installing IT servers, storage, and network equipment. By making it easier to install and de-install equipment, IDC believes assumptions about equipment being extended or purchased at the end of the initial lease term will likely need to be revisited.

Many IT leasing and financing providers will evaluate these emerging technologies and conclude that different risk-management assumptions should be considered as these technologies are deployed. The overall effect of this could be additional conservatism when structuring leasing structures, reducing the relative competitive edge of this financing alternative versus financing, further shifting the product mix towards those products.

Huge Opportunities; New Challenges

The $1.1 trillion IT market is probably the second largest market in the world — some have estimated the tourism industry is the largest at some $6 trillion. IDC forecasts the worldwide IT leasing and financing industry to reach $100 billion by 2010. It is an amazing market with numerous segments: hot emerging opportunities, large, strong, mature markets with modest growth; and segments with sharp edges for the careless. For many end-user companies, as much as 30% of all their capital expenditures are focused within IT.

IDC believes the overall IT market remains one of the most dynamic and interesting worldwide. Billions will be won and lost as new technologies displace and replace existing systems. For those of you with teenagers at home, simply observe how they interact with these new tools. They will plainly tell you that e-mail is old-fashioned, and they will likely say that you are the only one who sends them any.

New computers and new technologies will continue to emerge, and companies will continue to acquire them in search of competitive advantage. The demand for IT leasing and financing will remain robust through the forecast period. The challenge for IT leasing and financing providers is to recognize the shifts in IT spending, to understand the multiple market forces tilting the IT financing equation from leasing towards financing, and to remain cognizant of the changes emerging technologies may introduce into the business risk equation.

Joseph Pucciarelli, program director of Technology Financing & Management Strategies, provides a wide-range of research on IT leasing and financing strategies to both providers and IT organizations, IT organization management practices such as chargeback, funding strategies and capital allocation strategies; and IT organization financial practices such as equipment and software capitalization guidelines, vendor management, and on-demand contract management. He provides research coverage for leading IT financing providers such as CIT, HP Financial Services, GE Capital, IBM Global Financing and Oracle Financing Division; as well as supporting financing program pricing, residual risk management and distribution strategy analysis.

Pucciarelli’s research is published principally within IDC’s Technology Financing Strategies and Technology Valuation Services; and Industry Insights’ IT Management Service research programs. Pucciarelli is a noted analyst who has been quoted extensively, as well as a frequent presenter at business conferences. With more than 20 years of broad-ranging business experience in the financing and technology industries, Pucciarelli has held a variety of consulting, product marketing, risk management and senior management positions with companies including Gartner, GE Capital, Peregrine Systems and his own company, ComplianceOfficerForum.com.

IDC is a global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community make fact-based decisions on technology purchases and business strategy. More than 900 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in more than 90 countries worldwide. For more than 43 years, IDC has provided strategic insights to help our clients achieve their key business objectives.

Joseph Pucciarelli is the Technology Financing & Management Strategies program director for IDC, a global provider of market intelligence, advisory services and events for the IT, telecom and consumer tech markets. Pucciarelli provides a wide-range of research on IT leasing/financing strategies as well as coverage research to IT organizations and leading IT financing providers. With 20+ years of experience in these industries, he has held a variety of consulting, product marketing, risk management and senior management positions with companies including Gartner, GE Capital, Peregrine Systems and his own company, ComplianceOfficerForum.com.

Joseph Pucciarelli is the Technology Financing & Management Strategies program director for IDC, a global provider of market intelligence, advisory services and events for the IT, telecom and consumer tech markets. Pucciarelli provides a wide-range of research on IT leasing/financing strategies as well as coverage research to IT organizations and leading IT financing providers. With 20+ years of experience in these industries, he has held a variety of consulting, product marketing, risk management and senior management positions with companies including Gartner, GE Capital, Peregrine Systems and his own company, ComplianceOfficerForum.com.

No tags available