Remember the old adage “You ain’t seen nothing yet?” Well, the last 12 months have proven that in spades. Uncertainty, confusion, wild fluctuations in the stock market, the value of the dollar, bank failures, unprecedented moves by the Federal Reserve to avoid financial collapse and inflation, food prices, oil and gas prices spiraling have all led to the feeling that things are out of control. Yet, despite all of these factors there are many things in the manufacturing sector that remain stable. I will attempt to provide some insight into the issues impacting the lending community that supports the manufacturing industry and will argue that manufacturing is actually a key reason our economy has remained on its feet.

U.S. Treasuries

Although the U.S. Treasuries have been the pricing benchmark for the industry for years, they are no longer as accurate an indicator as they once were. Given the credit and liquidity crisis facing the financial community, there has been a significant flight to quality. Therefore, many investors pulled their monies out of riskier investments and placed them in U.S. Treasuries. As a result, the yield being paid for Treasuries took a sharp turn downward and the relationship between the true cost of funds for financial institutions and the U.S. Treasuries developed a wider and wider gap. This caused many funding sources to shift their pricing to other indices (swaps, own internal cost of funds, etc.).

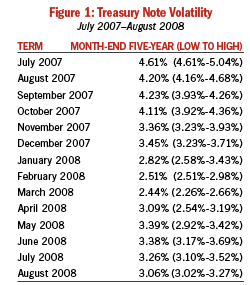

Month-end rates dropped significantly from July 2007 through March 2008, then took a turn sharply back the other direction and for the moment have settled. It is also clear that in many months there was significant fluctuation in rates. This volatility drove funding sources to switch to other more stable indices.

Despite the fact that institutions may have some capital constraints now and in the future, there is still plenty of capital available in the market. In fact, today, the competitive environment appears to be thriving and the financing rates available to customers for the acquisition of equipment are some of the lowest we have seen in the past ten years (although slightly higher than they were a year ago). Whether it’s a small regional bank, a major bank or an independent lender, there continues to be a real fight for market share and customer retention. Manufacturing equipment has a long useful life and holds its value well, and given those facts, it will always be the type of market that lenders will support.

Application-only financing continues to dominate the commercial finance landscape and many lenders offer application-only processing for transactions with limits from $150,000 up to $350,000. In addition, wholesale sources have the ability to place transactions with various lenders so that in theory, over time, a company can borrow in excess of $1 million without a financial statement being required (provided there are multiple machines).

Application-only financing represents over half of all transactions (by number) financed in the manufacturing sector and if transactions are not processed application-only, then the transactions are reviewed using financial statements. The beauty of the application-only profile is that customers that qualify show the propensity and willingness to pay and have continued to demonstrate that over several years.

Delinquencies in the overall manufacturing sector continue to remain low. The two manufacturing segments that have experienced increased delinquencies are the woodworking (housing related) and automotive sectors. Other than those two areas, the rate of default in most portfolios today is at an historically low level. This bodes well for any upcoming slowdown (or recession) that the U.S. may experience.

The delinquency rates going into the last major downturn (mid-2000 through early 2003) were much higher than they are today. In the last recession, manufacturing led the way into the recession and was the last to recover. Delinquencies today are nowhere near those levels and manufacturing is one of the most stable segments in our economy today.

To support the notion that the U.S. manufacturing sector is performing at a very strong level, I would like to provide a brief overview of some of the factors impacting the industry and to discuss specific comments recently made in the media. The good news is that the outlook continues to be positive in all but a few segments:

Exports

Howard Schneider, in a Washington Post article dated August 29, 2008, noted that U.S. economic growth accelerated from April to June as taxpayers spent their federal rebate checks and a weakened dollar boosted exports. According to new data from the Commerce Department, gross domestic product grew at an annualized rate of 3.3% in the second quarter of the year, the fastest rate since mid-2007. The department had initially estimated annualized growth for the period to be 1.9%, but more complete data —

particularly on exports by U.S. companies — showed the economy to be growing faster.

This growth is largely driven by the manufacturing sector. The U.S. has always had a manufacturing base that consistently produces excellent quality product, but has had a difficult time competing based on its higher cost of labor. The decrease in the U.S. dollar has allowed U.S. companies to become much more competitive in the global market and this has fueled our exports.

Job Shops

There are roughly 23,000 independent machine shops in the U.S. with combined annual revenues of $30 billion. Most of these operate a single shop. The industry is highly fragmented, with the 50 largest companies holding less than 15% of the market. One challenge that impacts many small machine shops involves concentration. It is risky to acquire a large share of work from a single source, however, many small shops find themselves in that position. Diversification of industries and sources should be important goals going forward. From an historical point of view, in the 1970s, shops went from manual to Numeric Controls (NC) and in the 1980s from NC to Computer Numeric Controls (CNC). At that time, if a shop didn’t convert it felt that it would be out of business.

Over the last 25 years, CNC has continued to show improvements in quality, repeatability, accuracy and speed. Additionally, the equipment is not substantially more expensive than it was many years ago based on its productivity today. However, the independent shops are now faced with the newest challenge — automation.

Given the global economy and the ease of placing jobs around the world, automation is becoming necessary in order to compete for the larger, long-term jobs. Finding qualified, trained labor in the manufacturing sector continues to be one of the most difficult issues shops face today. Therefore, unmanned equipment with a large amount of automation is the solution in many instances. It is believed that to effectively compete in the next ten years, automation will be a critical piece of the solution.

The industry has been significantly impacted in recent years by a variety of issues. Foreign competition (from 1996 to 2006 the big three U.S. market share had dropped from 73% to 54%), fuel prices, increased emission standards, raw material prices (steel, aluminum, plastics and coatings have all had dramatic price increases), and the consumer having less money to spend have all resulted in tough times for the auto industry. The industry will have to find alternatives including fuels, “green” vehicles, improved safety and shift to more cars and less trucks to recover from the current issues they face.

Aerospace

The aerospace industry has been very robust over the recent years. The U.S. military budget, demand for new commercial aircraft, emergence of “Micro Jet” airplanes, emphasis on operating efficiency, growth of business jets and increased use of automated controls are driving the industry to significant levels of backlogged orders and contracts that will last well into the next decade. There are no signs of a slowdown in aerospace today.

Defense

With the war in Iraq, Afghanistan and other potential conflicts swirling, the budget for defense spending is expected to remain at very high levels for the foreseeable future. Defense equipment is primarily manufactured by U.S. companies and should continue to support strong results in the manufacturing sector.

This industry remains strong and is fueled by both import and export activity. The high value of electronic components and their low weight mean that transportation costs are relatively very inexpensive. The worldwide demand for electronics continues to surge. Demand for semiconductors and other electronic components are expected to grow by 20% to 30% per year.

Although demand for desktop computers is expected to slow, demand for servers, mobile computers, telecommunication devices, music players and imaging devices (scanners, digital cameras, etc.) will grow. This industry segment will continue to be strong for many years to come.

Energy

Between oil and gas production, wind power, new power generation plants and other forms of new energy sources being developed, the outlook for the energy segment should be very strong over the next decade. There is no end in sight for domestic oil production (to cut dependency from foreign producers) and there is a major emphasis on creating more alternative sources of energy. Research and development will create continued opportunities for the manufacturing sector.

Medical

Demand in this segment is driven primarily by demographics (age) and medical knowledge and technology. Based on these drivers, this segment continues to flourish. The profitability of individual companies depends on the ability to develop superior products, but the number of companies bringing new products and technology to the medical field is significant.

Other drivers in the medical segment are wireless devices (implantable, hearing aids, etc.) and the need for reprocessing medical devices. More and more doctors/manufacturing teams are adopting wireless capabilities into their designs. In addition, the U.S. healthcare system discards $6 billion worth of obsolete medical supplies and devices each year.

Finally, and most significantly, from 2000 to 2020, the numbers of Americans over the age of 65 will grow to more than 50% of the population. The demand for medical devices and technology improvements will only increase into the future.

In summary, the manufacturing sector is performing at a very strong level despite the economic challenges the U.S. has experienced and the uncertainty the lending community is facing. The strength of the demand in many manufacturing segments should continue to keep the U.S. manufacturing base on solid ground. Once the economy has hit bottom and begins to rebound (many experts estimate a late 2009 improvement), this should prove to be an even better climate for manufacturing as we move into the next decade.

No tags available