As a service industry, equipment leasing is perpetually dependent on variables outside of its control and is therefore destined to endure the fluctuations of whatever market it serves.

Like a pebble tossed into a pond, one tiny disruption can send ripples throughout the entire industry. Now imagine what two pebbles might look like, and you’ll get a good picture of what the past year has been like for the trucking sector.

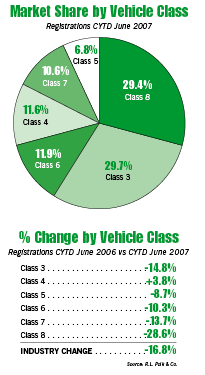

In 2007, the industry suffered a one-two punch, simultaneously hit with a dip in freight tonnage and costly changes to emissions guidelines. The result: following a record year in 2006, the market for new trucks has atrophied.

It wasn’t like no one saw it coming. The slump was as inevitable as had been the surge — a product of regulatory changes with a significant impact on the cost of engines and, by extension, trucks.

“What really drove the pre-buy in 2006 was the federally mandated exhaust emissions reduction for post-2006 engines,” explains Keith Hahn, managing director of the Transportation Group at Banc of America Leasing & Capital. “We experienced a very strong year for funding these assets in 2006 and fully expected to see a significant drop-off in this type of business for trucking companies.”

By 2010, the Environmental Protection Agency (EPA) hopes to greatly reduce the amount of hydrocarbons and other noxious gases released into the atmosphere by the nation’s transportation industry. That’s good news for the environment, but for manufacturers of diesel trucks and engines and the companies that lease and finance them, it’s been a somewhat different story.

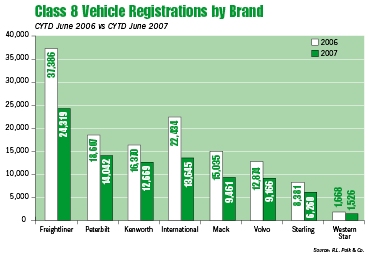

For trucking fleets, the solution was a no-brainer: stock up on new inventory before the change takes effect. Throughout 2006, fleet managers bought … and bought and bought and bought, so that by the end of the year, manufacturers and distributors of heavy-duty vehicles had sold 284,008 Class 8 trucks — 21,292 more vehicles than were sold in 1999, when the last sales record was posted.

For dealers and leasing companies alike, the lead-up to the emissions change presented a significant — if temporary — windfall.

“We saw a huge 2006,” says Bob Krefting, VP of Direct Markets at Fifth Third Leasing, “a very large amount of our business wound up being new power equipment with everybody loading up on everything prior to the emissions change.”

And then the industry settled in for a long, cold winter. As the new year began, engine and truck makers were speculating that the new emissions regulations could add as much as $12,000 to the price of a new truck, while dealers girded for a serious market slump.

Just how bad it will end up being is still up for debate. Steve Latin-Kasper, an analyst with the National Truck Equipment Association, has predicted that U.S. sales of retail trucks will drop to 187,000 in 2007, down 34% from 283,000 last year. The medium-duty market will also take a hit, though not as severe, he said. Others say it will be worse, with sales reductions approaching 50%.

As if the emissions regulations change wasn’t enough, on the service side, the slump in the housing and auto industries has led to reduced freight volume, amplifying an already tough situation for many leasing companies.

“I think that everyone was certainly expecting that with the emissions change this year there was going to be a down year in trucking, but I think it’s been exaggerated by the fact that there’s a slowness on the revenue side with a lot of the carriers as well.” Krefting says.

John Eide, senior vice president of the Commercial Vehicle Group at Wells Fargo Equipment Finance says the combination of the two factors has definitely impacted the industry.

“The decline in Class 8 sales in 2007 is not a surprise,” says Eide. “After record 2006 sales, typically you would expect to see a bit of softening, but the combination of the pre-buy and the freight slowdown has presented some challenges.”

At press time, freight volume was down 11 out of the past 12 months, and showed no immediate signs of rebounding.

Irwin notes that taking into account the 2006 pre-buy, the slowdown in freight tonnage came at a bad time. “The softening of freight is definitely a signal that the industry needs to pay attention to because that, coupled with what has been an extraordinary addition of capacity in 2006, is beginning to affect freight rates that companies are able to acquire,” he says.

Data released by the Bureau of Transportation in August shows freight transportation was down 3.7% in June 2007 from its peak in November 2005. June’s freight transportation service index (TSI) was down 3.4% from its June 2006 level, the largest June-to-June decline in the 17 years.

The first six months of 2007 was the first time since 2003 that the freight TSI failed to increase during the first half of the year and only the third time in ten years.

Those in the transportation leasing industry point to a domino effect caused by a slowdown in other sectors of the economy — beginning last year — which is affecting the bottom line of their customers. “The housing market has been drying up so we’re seeing that with some of the people that have been delivering to those markets, their business is suffering,” Krefting says.

“What additionally impacted the reduction for need of financing of these types of assets is that the retail and manufacturing sectors of the economy experienced a softening in the third and fourth quarter of 2006 and the soft market has continued through the first half of 2007,” adds Hahn. As a result, he says, “virtually all fleets have not grown beyond 2006 levels and some have actually contracted due to exiting less profitable business segments, or the re-optimizing of fleet assets due to mergers or acquisitions.”

If there’s any good news, it’s that the industry had plenty of time to prepare. Hahn says that mostly entails understanding the nature of the sector and sticking to a plan.

“Our institutional strategy and approach has not changed, we know this is a cyclical business and our underwriting standards have been calibrated for these types of events,” he says. “The wrong approach would be to simply exit the market like several other banks did in 1997 and 2001.”

Krefting agrees. “You know, it’s something that everyone was expecting. The trucking industry has always been historically cyclical — so I think everyone was looking for a downturn in the marketplace.”

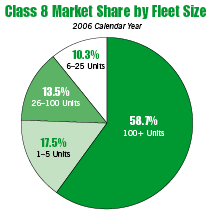

Krefting says Fifth Third has historically made an effort to maintain a conservative approach to the trucking industry, focused on the upper quartile of carrier — as he explains it, “the people who have the track record of riding through the rough times.

“The smaller carriers are usually the kind of people we have shied away from, because those are the people that are going to struggle,” Krefting says. “We really stick hard to what our underwriting principles have been — concentrating on those upper-echelon companies.”

The common theme seems to be: when it comes to leasing and financing truck fleets, it’s inadvisable to put all your eggs in one basket.

“Everybody in trucking understands it’s a cyclical business. It has usually fairly predictable cycles, more than some other industries,” says Krefting. “We’re predominately a generalist so as we see this sector turndown, we’ll try to make up the volume somewhere else, in other industries.”

“Our focus in today’s market is to be in front of as many users today as we were yesterday,” adds Eide. “The important thing in today’s market is that the customers know what they can expect from you so they can make decisions in managing their business.”

Meanwhile, with fuel prices leading to a rebound in the rail industry, more trucking fleets are turning to alternatives, like intermodal, to make up some of the lost revenue.

Irwin admits that Key Equipment Finance has been exploring alternatives, but he won’t go into details. “We’ve focused on those industry segments where we had not played to any significant extent,” says Irwin. “You can create growth as an organization by focusing on new niches that you didn’t previously play in even though the overall market is declining. I think it’s safe to say there is opportunity.”

Still others take the long view. “We’re a long-term player in this and understand the cyclical nature of the industry and what our customers need to know is that we are in this for the long run and we want to deliver a customized product that helps them manage their business through good times and bad,” says Eide.

Eide sees a similar time frame. “Well, we don’t have a crystal ball, but from what our customers and vendors tell us there is optimism for a late 2007 or early 2008 rebound. We’re anxious to see what happens.”

He notes there are a number of factors that might influence a turnaround: the strength of the 2007 holiday rush, what happens over the next several months in the housing markets and fuel costs.

But Hahn warns that if a turnaround isn’t forthcoming, weaker players may begin to falter. “If the economy continues to stay soft, driven by outside factors like consumer confidence, the housing slump and raising interest rates, credit will become more difficult to access for underperforming and higher leveraged companies,” he says, adding, “This has always been a cyclical business and is not for the faint of heart or fair-weather player, but rather for the institutions that understand and specialize in the industry and asset types.”

No tags available