In this in-depth analysis of Monitor’s Bank 50 results, Capgemini’s Steve Byrnes and The Alta Group’s Melisa Carter discover a surge in IT spending and an increase in compliance costs and complexity.

IT spending is surging in our industry, but with lowered expectations regarding transforming organization cost structures. Business executives now believe that broader business strategies must be key components of major initiative business cases. They have also discovered that the cost of greater compliance and managing the increasing complexity of their organizations greatly reduces any benefits from IT-driven efficiency gains. Our study of the Monitor Bank 50 organizations over a seven-year period yielded some surprising findings and thoughtful discussions.

Efficiency driving and cost optimization have been the leading impetuses for technology investments over many years, according to ELFA operations and technology survey responses. Whether times are good or it’s a down year, these drivers have consistently been the key focus of participants. But, aligning objectives is not necessarily the same as achieving them, much less determining if the objectives are the right ones in the first place.

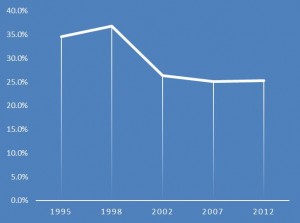

Interestingly, the operating expense ratio of the industry declined by over a third to 26% (of revenues) over the years approaching 2002. This was a transformational shift, but the ratio has remained at that level since then (see graph). Is it possible for the industry to truly transform its cost structure again?

To understand the impact of efficiency driving initiatives — “doing more with less” — we performed a study of the Monitor Bank 50 organizations over a seven-year period ending in 2013. What we found was both surprising and, based on follow-up discussions with organizations, understandable. The average annual efficiency gain of these industry leading organizations was 5.1%. Over 60% of organizations became less efficient in two or more years and very few organizations — three to be exact — experienced efficiency improvements in all seven years. From a business success perspective, incremental gains of 5.1% barely move the return on equity needle — less than 0.2%.

Few organizations we spoke with blamed their poor efficiency improvement results on technology. Technology options available to equipment finance firms are better than ever. Origination and servicing systems of even five years ago pale in comparison to the current array of offerings. CRM solutions have made their way into the technology footprint of most firms, analytics capabilities have moved from drawing-board vision to practical application and ecommerce technology solutions move forward faster than one can generally keep up. Many of these are the same technology underpinnings that are radically reducing costs in the business to consumer space. A few other theories we heard, however, help to make some sense of the challenging nature of transforming costs:

While many organizations view cost optimization as a critical business driver for large scale initiatives, close attention should be paid to:

No categories available