Chris Hemler,

Senior Vice President,

Hovde Group

While merger and acquisition activity in the equipment finance industry paused during the depths of the COVID-19 pandemic, conditions driven by cash-rich businesses hungry for growth are aligning to make the post-pandemic market one of the most active of the last two decades.

Coming off a strong year in 2019, 2020 started with four deals announced before March 2, but during the spring and early summer of last year, business priorities shifted away from growth and toward liquidity and revenue preservation. With COVID-19 infection rates continually rising and no end to the pandemic in sight, early to mid-2020 was no time for an opportunistic seller to enter the market. Banks and strategic acquirers of leasing businesses were similarly distracted, leaving financial sponsors on the hunt for cheap deals. But lessors weathered the lockdowns fairly well, viewing the pandemic as temporary and proving to be unwilling to take the discounts buyers expected. As a result, a pricing expectation gap emerged, making the few existing transactions difficult to close. After March 2, only two transactions were announced during what was essentially a six-month hiatus between May and November.

Due to either COVID-19 fatigue or the imminent rollout of the first vaccine in December, market uncertainty began to fade in the fall and early winter of 2020. Record borrowing during the early months of the pandemic left companies with stockpiles of cash to deploy as sellers grew more confident taking their businesses to market. Through June this year, nine equipment finance transactions have already been announced. (See Figure 1)

Today, buyer interest in the equipment finance and broader commercial finance industry has reached a fever pitch. A quickly rebounding economy, continued government spending, excess balance sheet cash, low borrowing costs and potential tax rate increases for investors have combined to make the current equipment finance M&A market potentially the most active since before the Great Recession. Banks, insurance companies and private equity firms are increasing their interest in equipment finance, elevating competition and company valuations. While not the only acquirers in the industry, these three buyer types are driving the market and worth exploring in more detail.

Banks Want to Profitably Deploy Excess Capital

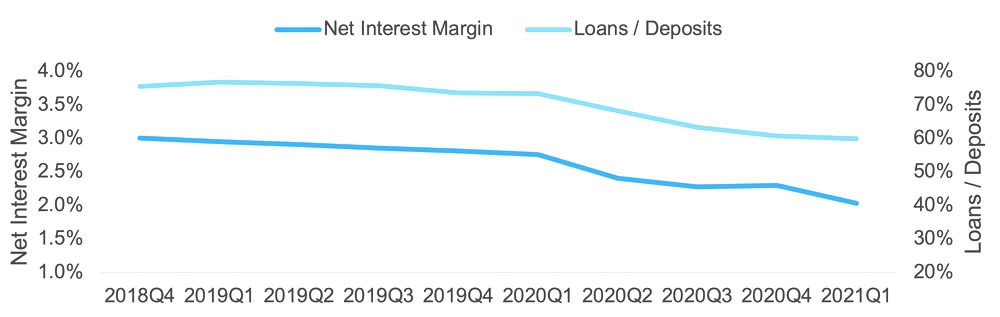

The most logical place to start is with the buyers that set valuations in most market cycles: banks. By replacing a warehouse facility or a non-recourse line with deposit funding and allowing for higher leverage, a bank will immediately increase the profitability and return on equity of an equipment finance platform in any market. But multiple factors are making equipment finance acquisitions particularly attractive for banks right now. Quantitative easing, government stimulus and an average personal savings rate of nearly double the 50-year average (17% versus 9%) have caused deposits to swell in 2020, but banks have struggled to deploy this excess capital at attractive margins. Commercial real estate is facing fundamental changes and increases in commercial loan originations have been driven by Paycheck Protection Program loans with lender processing fees of only a few points. Acquisitions of equipment finance businesses will be an attractive way for banks to diversify their product offerings and expand profitability while minimizing the impact on portfolio composition. (See Figure 2)

Several bank acquirers of equipment finance businesses have announced or closed their own acquisitions or mergers in recent months, most notably People’s United Financial, Sterling Bancorp, Huntington Bancshares and Radius Bank. These banks were ideal acquirers because of their proven asset origination capabilities and strong net interest margins, primarily due to prior specialty finance acquisitions. Now a new wave of banks, often under $10 billion in assets and located outside the traditional money centers, have picked up on the strategy and are looking for what would be their first meaningful equipment finance acquisition. More banks in the mix means more competition and higher valuations, which is music to the ears of sellers.

Rising Influence of Insurance Money in Private Markets

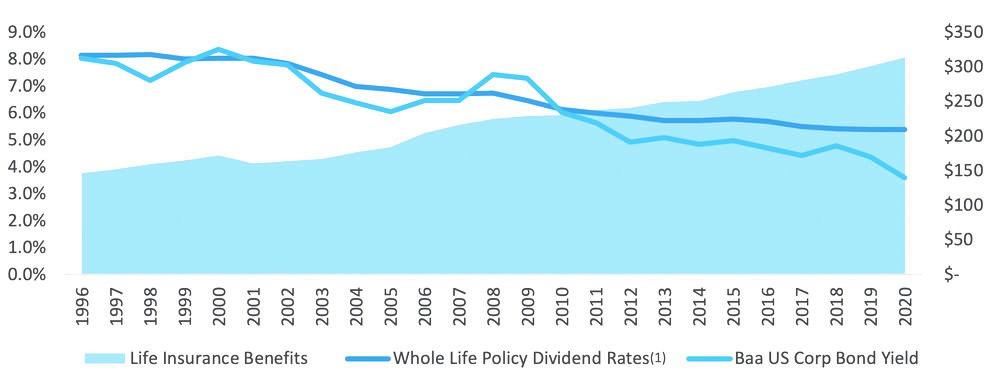

Yields on corporate bonds and other traditional insurer investment safe havens have been on a sharp decline for the last 10 years as the bills are coming due on the expensive long-term care and universal life insurance policies written during the insurance boom of the 1980s and 1990s. In 2020, the spread between Baa U.S. corporate bonds and average whole life policy dividend rates grew to 1.8%, the largest deficit in the last 15 years. So, in an attempt to avoid the headline risk of doubling premiums on life insurance policies during a pandemic, insurance companies are getting creative. (See Figure 3)

Insurers have long been comfortable with equipment finance as an investment asset class. However, yields in the ABS market have tightened significantly since 2010 and have only been exacerbated by several bank acquisitions of frequent securitizers in recent years. To solve this issue, insurers are turning to the private markets for proprietary asset flow, typically by partnering or acquiring an asset manager with expertise in underwriting and supervising private companies.

“In addition to participating in well-attended capital markets processes, certain insurers are trying to source proprietary assets by partnering with platforms — moving from the dining room into the kitchen,” Ethan Wang, a co-founder and partner at BharCap Partners, a financial services focused private investment firm with experience in the insurance industry, says.

The combination of flexible, patient insurance money and the private market investing expertise of asset managers creates an ideal acquirer of capital heavy businesses, and more insurers are jumping on the trend. The model is also highly attractive for equipment finance sellers, as it merges the entrepreneurial approach of asset managers with permanent capital and avoids the bank regulatory environment.

Dry Powder and Low Borrowing Costs Drive Private Equity Acquisitions

Private equity fundraising dropped 36% in 2020 but remained healthy at $200 billion, and a strong bounce back to $330 billion raised is expected in 2021. This would beat the previous record of $317 billion in 2019. Under contractual obligations with limited partners to deploy their money, private equity firms are hungry for deals in an already crowded buyer’s market. However, attractive businesses at below market prices are increasingly difficult to find. So, with the aid of low borrowing costs, sponsors have been reluctantly increasing the valuations they are willing to pay. (See Figure 4)

Across the private equity landscape, the percentage of acquisitions made at more than 12 times EBITDA has reached 60%, more than double the average from the previous decade. This trend is expected to continue over the near-term as limited partners continue to pour money into private equity.

All Eyes on M&A

The demand for equipment finance acquisitions has rarely been higher than it is right now. An auction process that pits banks, insurers, private equity firms, business development companies and other strategic acquirers against one another and plays off each group’s strategic nuances has a better chance of achieving outsized valuations in the current market than any time in recent memory. Combine all this with uncertainty around the timing and magnitude of potential tax rate increases on capital gains and carried interest, and you can expect to see a number of deals announce in the second half of this year.

Chris Hemler is a senior vice president on Hovde Group’s specialty finance investment banking team, the top ranked M&A practice to the commercial finance sector, according to S&P Global Market Intelligence (2019 and 2020). Hemler specializes in advising equipment finance companies on sell-side and buy-side transactions, valuations and debt and equity capital raises. He can be reached at [email protected] or 703-214-8524.

No categories available

No tags available