Late last summer, after a 16-year career as an entrepreneur and “intrepreneur” with four companies ranging in size from $1 million to $30 billion, I began exploring the alternative energy landscape and quickly realized that equipment financing for commercial solar projects could be a high-growth market. Given the significant federal tax credits and state incentives for alternative energy equipment, it made financial sense to launch a company dedicated to alternative energy finance. I subsequently founded a leasing company, GreenTech™ Lease Finance — focused solely on solar, wind, geo-thermal and bio-fuels. As it turns out, my timing coincided well with the surge in energy costs and the rise of clean technology and environmental awareness.

A Rapidly Growing Market

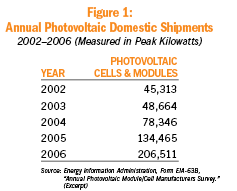

The increase in conventional energy costs over the past decade combined with the growing awareness of sustainability has created significant and growing demand for solar energy. More than 80,000 solar installations were completed in 2007 — a 45% increase over 2006 — of which 26,000 were electricity-producing solar photovoltaic (PV), according to the Interstate Renewable Energy Council. Based on capacity, approximately two-thirds of these solar PV installations were commercial projects. In terms of growth rates, from 2005 to 2007 the capacity of solar PV more than doubled.

In terms of dollars, the Solar Energy Industries Association claims the solar industry in the United States shipped approximately $700 million of cells and modules in 2005, $1.1 billion in 2006, and an estimated $2 billion in 2007. Clearly, this is a dynamic market with significant growth and momentum.

At the state level, certain geographies are obviously more conducive to solar equipment based solely on the amount of solar energy. From an economic standpoint, however, the amount of sunshine is only one consideration.

Three additional factors must be considered to determine the best geographies for solar equipment: energy cost, state rebates (in several different forms) and state tax credits.

The Impact of Tax Credits and Incentives

The Solar Energy Industries Association states on its website: “The greatest challenge the U.S. solar market faces is scaling up production and distribution of solar energy technology to drive the price down to be on par with traditional fossil fuel sources.” Because it will take time to scale up the solar industry infrastructure, there is a significant short-term challenge: the ongoing failure of Congress to pass legislation to extend the 30% solar federal tax credit.

The 2005 Energy Policy Act included a 30% federal tax credit (ITC) for commercial solar installations, along with very strong tax incentives for wind production. This had a dramatic impact on the growth of the solar industry over the past three years. The 30% ITC is set to expire on Dec. 31, 2008 unless Congress renews or extends it through legislation pending at the time this article went to press.

According to a study prepared by Navigant Consulting, Inc., for the American Wind Energy Association and the Solar Energy Research and Education Foundation, the expiration of the ITC could result in $6.2 billion of lost investment and over 30,000 lost jobs. Without the ITC, Solar PV sales in 2009 could total less than half of what they could be with the extension of the 30% ITC. Commercial PV installations could be impacted even more dramatically as businesses tend to weigh the economic benefits of solar more heavily than the residential market.

On a state-by-state basis, cash rebates and tax incentives vary greatly. For example, California introduced the Million Solar Roofs program to great acclaim. The California Solar Initiative, rolled out in January 2006, is a state-funded rebate program administered by the utilities, which will distribute $3.3 billion over ten years for qualifying solar installations. New Jersey has started an incentive program that revolves around issuing Renewable Energy Certificates (REC) based on energy produced by a solar owner — which can be the lessor. These RECs can be sold in a nascent secondary market. Other states with expanding incentive programs include Florida, Maryland, New York, Nevada, North Carolina, Washington and New Mexico per the SEIA and Prometheus Institute’s, 2007 U.S. Solar Industry Year in Review.

State rebates and incentives are typically assignable; a lessor can often take advantage of these rebates and incentives and “share” the benefit with the lessee in the form of lower lease payments. An excellent resource to view and get a better understanding of the many state and federal incentives and their treatment is found at www.dsireusa.org.

To generate an attractive payment, relative to the energy offset, the majority of the lease proposals GreenTech™ has prepared for commercial customers rely heavily on the 30% tax credit and state rebates. Without the federal tax credit, it will be much more challenging in 2009 to propose lease structures that generate neutral or positive cash flow. However, state rebates combined with the potential reduction in equipment cost as supply begins to catch up with demand will allow for attractive leasing opportunities in selective states.

The EnerGLease™ — Solar PV Sample

Solar equipment has many attributes favorable to leasing. The equipment has a long useful life. There is very little maintenance — cleaning the panels a couple of times per year and replacing the inverter (typically around 10% of the original equipment cost) in about ten to twelve years. And, the residual values should be strong, depending on the pace of technology change. Historically, many solar panels have been in service for 20+ years and manufacturers typically offer a 25-year limited warranty. To qualify for rebates, many states require a ten-year unconditional guarantee.

The objective of virtually all solar vendors and their customers is to install a solar solution that is cash-flow neutral or even positive in relation to current electricity cost. For example, one project we worked on for a medical office worked out quite well from a cash-flow perspective. The customer was paying about $12,000 per year to its local utility company for electricity. A solar vendor configured a solar solution that would entirely offset the company’s annual utility cost.

Our objective was to structure a lease with a payment equal to or less than the $12,000 savings to avoid negative cash flow. We came up with a step proposal in which the lease payment would start slightly under the utility cost and increase annually at a 5% inflation rate — roughly matching the historic energy inflation rate for this particular utility. The total of the first-year monthly payments was $11,700, effectively saving the customer $375 in energy cost. The cash-flow benefit increases every year for the customer until the FMV negotiation at the end of the term (See Figure 2).

The total of the lease payments the customer will make over seven years, plus an estimated 20% residual, is significantly less than the original equipment cost. How can we accomplish this? The EnerGLease™ essentially shares the benefit of the 30% federal ITC, state and local rebates and incentives, and depreciation with the lessee.

It is important to note that this particular example works very well for three reasons:

The Funding Market

In the 1980s and 1990s leasing companies were burned by the solar industry — no pun intended. The amount of electricity production promised by the technology of that era was not realized. Systems labeled as 100 kilowatt systems were only producing 60 kilowatts of power. Customers that had leased their solar equipment walked away because of the poor system performance: they were actually spending more for electricity after acquiring solar equipment via a lease compared to conventional energy sources.

Fortunately, the dramatic improvement in solar efficiency has changed the dynamic for lease investors. Today, solar panels are rated as high as 23% efficient, compared to 10% just ten years ago. Several states have enacted energy production compliance standards to ensure solar projects perform as expected. At the federal level, the U.S. Department of Energy endorses solar calculator tools to verify energy production estimates as provided on the List of Decision Making Tools from the U.S. Department of Energy. These tools include the PV Watts Calculator provided by the National Renewable Energy Laboratory at PVWatts.org and the FindSolar Estimator at FindSolar.com.

Customers and leasing companies can now confidently support a solar installation knowing that the expected energy production will be realized. And, the credit risk is minimal considering a customer is essentially making a lease payment for electricity instead of writing a check for the same amount to their local utility.

Because of the improvement in technology and the low credit risk, the number of funding sources for solar projects has increased over the past few years, especially with the introduction of the 30% federal tax credit in 2005. There are basically three investment strategies at play in solar finance: traditional financing, lease financing and Power Purchase Agreements (PPA).

A PPA is a long-term agreement to buy power from a company that produces electricity. In general, an installer/investor buys and installs solar on a rooftop and provides a guaranteed amount of power to the PPA customer. The customer pays a fixed rate over a specified term, with some inflation factor added each year. PPAs function much like a lease in that there is a known payment plan, over a fixed term (typically 15 years), with a buyout option at the end of the term. The PPA provider is taking the risk on the amount of power the solar solution will actually provide — as they will pay the utility for any shortfall guaranteed to the PPA customer. The customer is taking the risk that the fixed energy cost will be equal to or less than the amount they would have otherwise paid for conventional electricity. And, they are entering a long-term contract.

We deliberately chose not to enter the PPA market due to the service and operating support requirements and instead focus solely on lease financing. To attract funding sources, we partnered with an experienced equipment leasing company that has numerous funding relationships in place — a few of which are attracted to solar. These funding sources range from small investment partnerships to multinational banks and leasing companies.

We are considering additional funding sources dedicated to clean technology. A private fund may emerge as our primary source of capital in the future. We will remain open to new funding sources interested in participating in clean technology investing as our business expands.

Marketing and Growth Strategy

Our marketing strategy is to offer a solid financial product —

the EnerGLease™ — through alternative energy vendor relationships to allow commercial customers the opportunity to acquire clean technology. The product will evolve as federal and state incentives change. Vendor relationships are initiated through direct marketing and nurtured through good service to them and their customers. Customer demand will grow as our vendor network expands. In terms of distribution, we manage most activity in-house and are selectively building an affiliate broker network committed to clean energy that will offer GreenTech’s EnerGLease™ to customers and industry contacts.

There is great interest in our approach and several trade organizations will become an effective stage for sharing our message and product offering.

How are we doing so far? GreenTech was launched earlier this year, and during our nascent existence we have established relationships with more than 50 vendors nationwide and have prepared over $100 million of custom proposals. Based on current activity, we expect approximately $10 million of solar leases to be signed by year end.

Future Opportunities

The solar equipment financing market offers attractive returns for investors with an easy to maintain, long-lived asset, with low credit risk. The solar market has grown very rapidly the past few years with the support of the 30% federal tax credit. Should Congress fail to extend or renew the tax credit, the solar industry faces a severe slowdown. We are optimistic that the solar industry has enough investment and critical mass to survive the potential tax credit expiration and will continue to expand, making it a lucrative niche for leasing companies.

No tags available