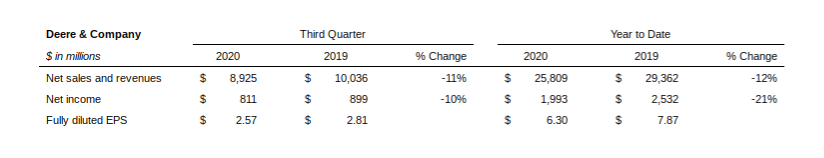

Deere & Company reported net income of $811 million, or $2.57 per share, for the third quarter ended Aug. 2, 2020 compared with net income of $899 million, or $2.81 per share, for the third quarter ended July 28, 2019. For the first nine months of the year, net income attributable to Deere & Company was $1.993 billion, or $6.30 per share, compared with $2.532 billion, or $7.87 per share, for the same period last year.

Worldwide net sales and revenues decreased 11% to $8.925 billion for Q3/20 and declined 12% to $25.809 billion for nine months. Net sales of the equipment operations were $7.859 billion for the quarter and $22.612 billion for nine months, compared with $8.969 billion and $26.182 billion last year, respectively.

“With outstanding support from our dedicated global workforce and dealer organization, John Deere delivered a strong performance in the third quarter in the face of a serious global pandemic and uncertain market conditions,” John C. May, chairman and CEO of Deere & Company, said. “As we manage through the pandemic, Deere’s No. 1 priority continues to be safeguarding the health and well-being of its employees. Thanks to aggressive measures taken early in the crisis, we have had success keeping our employees safe, our factories and parts centers functioning, and our customers served.”

Net income attributable to Deere & Company is forecast to be about $2.25 billion for the full year. However, many uncertainties remain regarding the effects of the global COVID-19 pandemic that could negatively affect the company’s results and financial position in the future. In addition, the company will complete broad employee-separation programs during the fourth quarter. The programs’ total pretax expense included in the forecast is about $175 million with estimated annual savings of $175 million.

“Although unsettled market conditions and related customer uncertainty are expected to have a moderating effect on key markets in the near term, we believe Deere is well-positioned to help make our customers more profitable and sustainable,” May said. “In addition, we are encouraged by the early benefits we are experiencing from the company’s recently launched smart-industrial operating model. We’re confident it will help accelerate our ability to deliver differentiated solutions to our customers, while contributing to improved efficiencies across the company.”

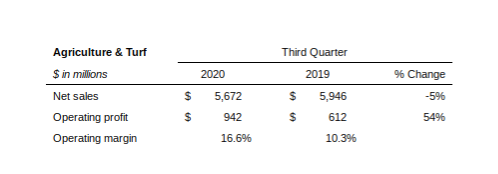

Deere’s worldwide sales of agriculture and turf equipment are forecast to decline about 10% for fiscal year 2020, including a negative currency translation effect of about 2%. Industry sales of agricultural equipment are expected to be down 5% to 10% from last year for the U.S. and Canada, while sales in Europe are also expected to be down 5% to 10%. South American industry sales of tractors and combines are projected to be down 10% to 15%. Asian sales are forecast to be down slightly. Industry sales of turf and utility equipment in the U.S. and Canada are expected to be down about 5% for 2020.

Construction & Forestry sales declined for the quarter due mainly to lower shipment volumes and the unfavorable effects of currency translation, partially offset by price realization. Third quarter operating profit declined due largely to lower shipment volumes/sales mix, partially offset by price realization as well as lower selling, administrative and general expenses.

Deere’s worldwide sales of construction and forestry equipment are anticipated to be down about 25% for 2020, with foreign currency rates having an unfavorable translation effect of about 1%. The outlook reflects market uncertainty as a result of COVID-19 as well as efforts to bring down field inventory levels. Industry construction equipment sales in North America are expected to decline by about 20% for the year. In forestry, global industry sales are expected to be down 20% to 25% due to weaker demand in North America and Russia.

Financial services net income for the quarter increased due primarily to lower losses on operating lease residual values; decreased selling, administrative and general expenses; and a reduced provision for credit losses. These items were largely offset by a higher provision for income taxes related to favorable discrete adjustments last year.

Full-year results are expected to decline due to a higher provision for credit losses and less favorable financing spreads, partially offset by lower losses and impairments on operating lease residual values.

John Deere Capital

Net income for the current quarter was about the same as Q3/19 with lower losses on operating-lease residual values; a reduced provision for credit losses; and decreased selling, administrative and general expenses, offset by a higher provision for income taxes from favorable discrete adjustments in the prior year. Nine month net income declined due to a higher provision for credit losses, unfavorable financing spreads, increased losses and impairments on lease residual values, and a higher provision for income taxes offset in part by income from a higher average portfolio.

Like this story? Begin each business day with news you need to know! Click here to register now for our FREE Daily E-News Broadcast and start YOUR day informed!