During 2008, U.S. organizations invested $1.09 trillion in new IT equipment and software — the second largest amount recorded since the U.S. Department of Commerce began tracking spending on IT equipment and software — just slightly less than spending in 2007, which was 2% higher.

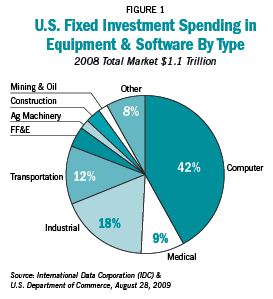

A quick glance at Figure 1 shows how U.S. companies invested their funds. Spending for computers, software, photocopiers and related devices, shown on the right side of the chart, comprised fully 42% of expenditures. Medical equipment comprised about 8% of investment spending. Continuing around the pie chart clockwise, the remaining categories include industrial equipment, transportation, furniture and fixtures, agricultural machinery, construction equipment, mining and oil extraction equipment — categories for the most part that are self explanatory for leasing and financing industry practitioners.

With this thought in mind, take a moment and return to Figure 1. Notice how on the right side of the chart, spending for computers and medical equipment — a.k.a. “high-tech” equipment — comprises some 51% of the total market. On the left side of the chart are the more traditional machinery types — the “heavy iron.” When I pulled this chart together the outcome surprised me. Not once did I ever suspect that the entire U.S. market for equipment and machinery had reached the point where it could be so neatly characterized — a 50/50 split between high-tech and heavy equipment. Again, for leasing and financing practitioners seeking to grow their businesses in a turbulent economy, this market characterization raises a number of questions as they create business development strategies.

Figure 2 quantifies one measure of this turbulent economy by showing the quarter-over-quarter change in equipment and software spending. A quick glance at the chart shows just how volatile the three quarters ending in June 2009 were. A decline of 7% in fourth-quarter 2008 followed by an 11% decline in first-quarter 2009 have thankfully been tempered by a decline of only 2% in the most recent quarter. As of this writing, Q3/09 data is not yet available, but the expectation is that the markets have stabilized somewhat, and that investment spending will begin to normalize.

Understanding IT Equipment Markets

PCs

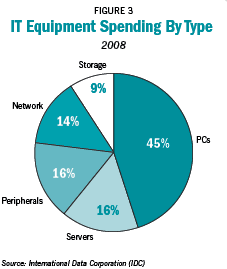

When most people think about capital IT equipment and investment spending, they tend to think about mainframe computers or storage equipment secreted away in secure data centers. And, while spending for data center equipment is a critical element of the investments in IT equipment and software, the single largest category of IT equipment spending is PCs — desktop and notebooks computers. As detailed on Figure 3, some 45% of all U.S. IT equipment spending is on PCs.

The past seven years of the business PC lifecycle have been dominated by the stable and reliable operating system, Microsoft Windows XP. Organizations avoided its first replacement, Windows Vista. However the next iteration, Windows 7, which was slated for a fall 2009 launch, appears poised to become the new standard.

The dominance of the Windows XP operating system created interesting dynamics in the PC leasing and financing segment. Many organizations, more than most leasing companies forecast, tended to buy their PCs in-place at the end of the lease — creating significant profit opportunities for many. As the cycle evolved, machines that were returned found a rich and ready secondary market. Prices for business-class PCs remained favorable, and a healthy secondary market ecosystem evolved.

The PC leasing and financing market outlook is somewhat uncertain. Many organizations recognize that they need to replace large segments of their PC portfolios due to both physical wear and tear on machines that are four-plus years old, as well as to improve the security of their business networks afforded by the new operating system.

Servers

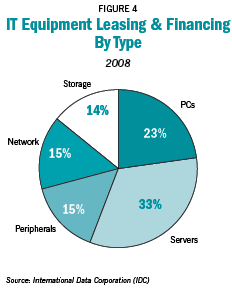

Servers, the workhorses of the IT infrastructure, are the type of equipment most frequently leased or financed. As shown on Figures 3 and 4, servers represented about 16% of the spending but one-third of the IT leasing and financing market. Servers are the tip of the competitive spear in the IT markets. They are big-ticket investments and influence the flow of other equipment, software and services expenditures. As a result, the manufacturers constantly leapfrog one another with faster and more efficient devices.

The problem with servers has been their inefficiency. Typically, a data center server runs at less than 10% of its capacity. However, a new technology, virtualization, has emerged that radically improves device utilization. Now, while this is obviously favorable for companies using servers, it has negatively impacted the server manufacturers. As companies shift to the new technology, their purchases of new servers have decreased. Combine this huge jump in device utilization with the normal 30% annual improvement gains from faster processor chips and the uneven economic climate, and IDC has forecast a flat server market for the next few years.

From a leasing and financing perspective, these intense competitive dynamics will create both risks and opportunities for IT leasing and financing firms. IDC expects that more servers will be bundled into packages of equipment, software and services wrapped with financing. IT organizations will likely invite independent leasing companies to bid on these packages, as well as the captives. For the independents with the underwriting expertise to understand these complex solution bundles, there will likely be significant business opportunities.

Storage

IT organizations continue to struggle with their storage practices. First, the sheer quantity of data housed on storage devices is staggering, and it continues to grow at an absolutely amazing rate. IDC forecasts that by 2013 the amount of computer data will increase five-fold — that’s 500%! Second, the regulatory guidelines for what data needs to be archived remain unclear. Should all e-mails be stored —

forever? Or, can they be deleted? When?

While U.S. investment spending for IT equipment storage aggregated 9% in 2008, leasing and financing activity comprised over 14% of the market.

IDC expects that leasing and financing activity of storage devices will continue apace with existing market trends. For IT leasing companies with the capability of sourcing, underwriting and managing the inherent residual value risk associated with these transactions, the economic outlook is positive. IDC believes that IT organizations, constrained by tight capital budgets are more likely to lease these devices going forward.

Network Equipment

Traditionally, network equipment was considered the most long-lived IT equipment. Cisco Systems is a dominant player in this segment representing from half to two-thirds of the sales in each category. Given that the equipment had a long and useful life, plus the fact that it was relatively difficult to configure, many companies purchased their network equipment. However, all this is beginning to change.

Many IT organizations continue to see their network traffic increasing at more than 25% annually — even as revenue only increased a few percent. As a result, in the past six months, IDC has noted a number of IT organizations moving to abbreviate the planned deployment for their network equipment.

From a market perspective, investments in networking equipment and their share of the leasing/financing market aggregated 14% and 15%, respectively, in 2008. For IT leasing and financing companies, the special challenge posed by network equipment is that most of the large devices are highly configured. In other words, each device might have hundreds of individual components within a larger chassis. If a device is returned to the leasing company, this can raise remarketing issues. Issues of software license recertification and configuration raise real complexities. In effect, it becomes a “parts-and-pieces” business — not something a leasing company wants to get into casually.

Peripherals

Peripherals, including printers and copiers, comprise a market segment marked by contradictions. On one side is the traditional photocopier segment for which leasing and financing strategies are an integral component of most manufacturer and distributors’ go-to-market strategy. Alternatively, regular printers, the ubiquitous laser printer found in virtually every business office, are generally not leased or financed. These devices are viewed as solid and reliable with their biggest maintenance issue being employee abuse.

For IT leasing and financing providers, this type of equipment comprises 16% of spending and some 15% of overall IT leasing and financing volume. IDC market research indicates that the growth in the number of pages printed annually has slowed somewhat both as a result of “green” initiatives and the overall economy. From a technology perspective, the devices continue to evolve incrementally. And while manufacturers continue to emphasize full-color devices, the prospects for black and white devices remain viable.

Essential Guidance

Companies invest in new equipment for one reason —

they intend to recoup more than the purchase price of the equipment in sales or lower expenses. IT equipment, compared with traditional machinery, has a relatively short, useful life — typically five years or less. The nature of the equipment itself continues to evolve, becoming faster, cheaper and less labor intensive (to install and manage). But, more to the point, the application of newer, better and more effective information tools to help analyze and manage the torrent of data streaming through most organizations continues to yield significant business value — Why else would U.S. companies spend over 40% of all their investment resources on IT equipment and software?

During second-quarter 2009, an analysis of financial services companies within the S&P 500 showed that they actually increased their investments by more than 7% over the preceding year. Most banks and financial services companies have no other investments beyond their computers. So, given the most turbulent market conditions they have experienced in 50 years, what investments are these companies making? The answer is information technology.

To summarize, IDC believes the following:

Joseph Pucciarelli is the Technology Financing & Management Strategies program director for IDC, a global provider of market intelligence, advisory services and events for the IT, telecom and consumer tech markets. Pucciarelli provides a wide-range of research on IT leasing/financing strategies as well as coverage research to IT organizations and leading IT financing providers. With 20+ years of experience in these industries, he has held a variety of consulting, product marketing, risk management and senior management positions with companies including Gartner, GE Capital, Peregrine Systems and his own company, ComplianceOfficerForum.com.

Joseph Pucciarelli is the Technology Financing & Management Strategies program director for IDC, a global provider of market intelligence, advisory services and events for the IT, telecom and consumer tech markets. Pucciarelli provides a wide-range of research on IT leasing/financing strategies as well as coverage research to IT organizations and leading IT financing providers. With 20+ years of experience in these industries, he has held a variety of consulting, product marketing, risk management and senior management positions with companies including Gartner, GE Capital, Peregrine Systems and his own company, ComplianceOfficerForum.com.

No tags available