W.M. (Rusty) Rush President & CEO, Rush Enterprises

W.M. (Rusty) Rush President & CEO, Rush EnterprisesAt the helm of the largest network of heavy- and medium-duty truck dealerships in North America, W.M. (Rusty) Rush — the president and CEO of Rush Enterprises — held a front row seat as he watched the credit crisis unfold, and he has been stoically weathering the storm ever since.

Starting in 2007, the U.S. trucking market was hit with a double whammy that knocked the wind out of the whole sector. First came new EPA diesel emissions standards, which went into effect on January 1 of that year. For months leading up to the change, the market for heavy-duty Class 8 trucks was off the charts as fleets stocked up on older, grandfathered engine models.

As Rush recalls: “2005 and 2006 were the two biggest years in the history of Class 8 truck sales.” Sales of Class 8 vehicles reached a record high in January 2006, and remained above average throughout the summer as buyers stocked up on pre-emissions models. By the end of the summer, it was clear that 2006 was going to be a record year for heavy-duty truck sales. But after leveling off at 23,894 units sold in August, new orders for heavy-duty trucks dropped more than 30% in September, with only 16,500 Class 8 sales recorded. The pre-buy of 2006 was over, and the trucking industry was about to embark on a two-year slide from which it still hasn’t recovered.

The sector took its second hit when the U.S. was gripped by the worst recession since the Great Depression following the collapse of the housing market in late 2007. Consumer spending plunged, retailers pulled back on stocking new inventory, and new residential and commercial construction came to a near standstill. The resultant drop in freight volume, which continues to this day, caught the industry off guard.

“You go back to 2003 and you thought you could tell a pretty good story for the next seven years to come,” says Rush. “You had the emissions standards change at the end of 2006, which was going to drive sales, you were coming off the recession of 2001-2002; you knew there would be pent up demand.

“And then of course the bubble started breaking. Freight tonnage started going down and started slipping. You had overcapacity, and obviously that’s been continuing just as freight tonnage has continued to go down even further.”

Both truck fleets and owner-operators reacted as expected: they stopped buying. And for those few that did want to buy, tightening credit markets made it nearly impossible to get financing.

By the end of 2008, Class 8 sales had dropped to a 16-year low, with 133,473 units sold. As February 2009 came and went, U.S. dealers and manufacturers clocked just 6,236 heavy-duty truck sales, according to WardsAuto.com — the lowest level in more than a quarter century.

Transportation in the Blood

Over the years the Rush family has built something of a dynasty in the trucking business. Rusty’s grandfather was in the bus business. His father, Marvin, founded Rush Enterprises in 1965 with two partners, and opened his first dealership in Houston, TX — which is still a major crossroads for east-west truck traffic. “The Rushes have been in transportation for three generations, so pretty much my entire career has been around the dealerships and in the trucking industry,” he says.

In 1967, the elder Rush made his first 100-unit fleet sale of Peterbilt trucks and started a leasing company, and a finance and insurance division. Nine years later, he bought out his partners and became the sole owner of the company.

Rusty Rush started in the family business when he was 16 — in the Rush tire center in Houston — and says he has worked in nearly every facet of the business since. Unlike some others in his shoes, for Rusty Rush, being the boss’ kid wasn’t exactly a cakewalk.

“With my father, you never got anything for free; you didn’t get it because your last name was Rush, you got it because you deserved it and I respect that. As I’ve gotten older, I’ve even gotten to respect it more,” he says.

Throughout the 1970s and 1980s the elder Rush aggressively expanded his company across the southern United States, which accounts for nearly a third of all new Class 8 truck registrations, and took it public in 1996. By July 2007, the stock had hit a high of $28 a share. It’s currently trading around $11 a share, near its 52-week high of $12.84.

In February 2006, Marvin Rush stepped down from the helm of Rush Enterprises, and his son Rusty took over as chief executive officer. The elder Rush remains with the company as chairman.

Today Rush Enterprises maintains dealerships and service centers in more that 50 locations in 11 states, representing some of the industry’s leading truck brands — Peterbilt, Ford, GMC, Hino, Isuzu, UD and Volvo. Rush also maintains a construction equipment dealership in Houston, where he represents John Deere construction equipment.

A Grueling Two Years

While Rush Enterprises’ size and scope has been a great help in enabling the company to weather the past two years, Rush doesn’t hesitate when he says it remains a very tough time for the company.

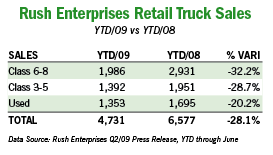

“I would tell you we’re sort of bobbling along the bottom — as an organization we’re staying a little above the mid-water mark, break even,” he says. “We delivered 12,000 Class 8 units in 2006 and we’re going to be somewhere around 4,000 units at best in 2009 — so that’s a two-thirds drop. I remember last year complaining about 2008, how difficult it was. But boy I’d love to have 2008 back right now.”

In the second quarter ended June 30, 2009 — the most recent data available — Rush Enterprises’ gross revenues totaled $312.1 million, a 31.4% decrease from 2008. The company lost $1.5 million in the quarter due to a $4.9 million pre-tax impairment charge related to General Motors’ decision to stop manufacturing medium-duty trucks and the wind-down of the company’s GMC Medium-Duty Truck Dealership Agreements. The company delivered 954 new heavy-duty trucks in the second quarter, compared to 1,665 in Q2/08.

Since the start of the recession Rush has continued to aggressively diversify the company and has managed to supplement Rush Enterprises’ traditional truckload and vocational businesses — such as construction and oil field service (both of which have been hit hard by economic conditions) — with forays into new sectors.

“We’ve dove into different vocations,” he says. “We have Rush Crane Systems, we have Rush Towing Systems, we have Rush Refuse Systems, and we recently got into school buses and commercial buses. That’s one of the things that helped us do well through 2008 … the diversification.”

Rush says that’s helped hedge some of the losses, but, he adds, it’s hard to find a sector that hasn’t been hit in some way by the recession. Rush says he hasn’t had to shutter any dealerships, nor does he plan to, but he has had to employ some painful belt tightening, including layoffs.

“We’ve had to manage our expenses extremely tight; it’s been a very trying last 21 months,” he says. “I’ve watched the organization go from 3,000 employees to 2,500 employees, and that is not a pleasure for anyone to have to do.”

But the good news, he says, is that the industry may have finally hit bottom. While heavy-duty trucks sales will end 2009 at record lows, some experts are tentatively reporting the beginning of a turnaround. Rush is reluctant to use that word, but, he says, there are some signs that things are slowly getting better.

“You get some slight upticks,” says Rush, “but they’re very slight; there’s still a lot of excess capacity out in the marketplace. It’s hard to find any pocket right now or any sector that you could really view as a catalyst for truck sales.”

And he says financing has eased only slightly. “Currently it’s still a very tight market; terms and conditions have loosened up some over the last six months, but the credit scoring is still extremely tight as to who the financial institutions will finance.”

Asked to predict when the industry might turn around, Rush offers a conservative estimate. “You’re probably going to see some deliveries pick up end-of-year and into the first quarter, but that is just what little is being driven by the emissions change,” he says. “True economic driven recovery … I wouldn’t expect until the third or fourth quarter of next year at best. There’s still too much capacity out there and we’re still going through a cleansing.”

In the meantime, he says, “We’re going to continue to do what we do best, and that’s to provide service and products to our commercial customer base; it’s our people that make the difference, it’s not Rusty Rush, it’s not Marvin Rush; it is our people that make the difference and it’s our people that will see us through this, and at the end of the day I think we’ll come out of this a much better organization, definitely a more knowledgeable organization.”

No tags available