Both leasing institutions and commercial entities that are interested in applying solar energy must first be familiar with the dynamics, technologies and costs of the systems. Wind, solar, geothermal and other sources of clean, renewable energy have become a priority for current and future energy needs. They have also become a popular product for today’s financial providers by means of leasing agreements.

What Is Solar Energy?

Solar energy converts sunlight into electricity through a relatively simple process using silicon-based cells and panels. The sunlight hits and is absorbed by silicon-based cells that are grouped together in a panel or “module.” The light is absorbed by the cells and a reaction between electrons causes a current flow, which together with voltage, creates electricity. The electricity generated is sent to an inverter in the form of direct current (DC). The inverter runs the electricity in DC through power switching transistors that rapidly switch on and off. This switching converts the DC current to an alternating current (AC) for use by utilities and appliances. This creation of electricity is performed by using a perpetual source of energy without the creation of any type of waste or byproduct that is harmful to the environment or needs to be disposed of.

In earlier solar collection systems, the energy would be stored in the form of batteries for use at a later date. The use of energy storage devices has been eliminated due to the fact that most buildings with solar collection systems are also connected to a conventional energy grid. In other words, a building with a solar collection system is similar to a hybrid vehicle. It operates on renewable energy as much as possible but still uses a more conventional source of energy as needed.

During the day, a building will rely upon a roof-mounted collection system as much as possible to meet the demand for electricity. When the sun is not out, energy is derived from the grid as needed. The use of solar collection systems will not eliminate the need for conventional electricity, but will allow businesses to use solar energy during the day when the demand for power is greatest. As the sun rises and passes across the sky, the demand for electricity increases. When the sun goes down, the demand for energy is at its lowest. Therefore, the electricity created by roof-mounted solar collection systems is used immediately to satisfy the demand for energy as much as possible.

Primary Components of a System

The primary components of a rooftop collection system are photovoltaic (PV) modules and the electric inverter, which comprise approximately 75%-85% of the overall system installation cost.

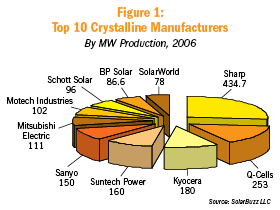

PV modules are receptors that absorb the rays of the sun. These modules are mounted to the roof in arrays that are tilted slightly to absorb as much direct sunlight as possible. Increasing the number of modules will increase the amount of electricity produced. There is very little difference between the various types of PV modules currently available, other than the level of energy in kilowatts (kW) that the panel is designed to produce. Figure 1 indicates the top PV module producers in megawatts as of the end of 2006.

Many of the top producers of PV modules are also top producers of computer chips. High-tech firms with a history in the production of computer chips, traditionally on the “cutting edge” of technology, have made a natural transition to the production of PV modules. This was a logical transition due to established production capabilities and access to silica, the primary component of both computer chips and solar wafers.

One difference between these two applications is that silicon used in chip manufacturing needs to be of the highest quality for maximum productivity, while silicon used in PV modules is not required to have such a high level of purity. This prevents each product from having a material effect on the production capabilities of the other.

While the PV module is designed to absorb the energy from direct sunlight, sunlight also causes degradation of the module’s capability to absorb energy. PV modules are currently designed with absorption rates of approximately 18%-20%. In other words, they are able to convert approximately 18%-20% of the amount of sunlight they are exposed to into electricity. As this function is performed, the ability to absorb the sun’s energy degrades at an estimated 0.5% per year. That means after 20 years, a PV module would still have an absorption capacity of 90% of what it was originally designed for. Due to the fact that PV modules do not have any moving components, the rate of degradation is the key factor in the module’s depreciation. In addition, PV manufacturers will provide a warranty of up to 20 years for the level of absorption of their modules. As a result of this information, the economic useful life for a PV module is longer than might otherwise be expected.

The electric inverter converts electricity generated by the PV modules from a direct current to an alternating current. This conversion allows the electricity to be used by conventional utilities and appliances as needed. There are several manufacturers of converters, and Figure 2 indicates the top manufacturers as of August 2006.

As with PV modules, the manufacturer of the inverter is not as important as the level of electricity the inverter was designed to handle. In some of the larger systems, the use of more than one inverter might be necessary.

Inverters are expected to last for 15 to 20 years, as the moving components within the inverters eventually wear out due to physical wear-and-tear. Most manufacturers will also provide a warranty for their inverters of up to ten years.

The Future of Technology

A with any asset, the onset of newer and better technology is a concern with lessors, and solar collection systems are no different. There will always be companies trying to develop more efficient technology. But with all of the concerns for advancements in solar collection, any financier should make sure they keep the following items in mind:

Leasing Considerations

Roof-mounted solar collection systems can be expensive and cost will vary depending upon the size of the system. In many cases, the only way businesses can obtain these systems is through leasing agreements with banks, which are currently limited to some of the larger bank leasing companies due to their greater resources and capabilities. The range in total installed costs based upon overall system size is indicated in Figure 3.

Financial Incentives

Rooftop solar collection systems are made economically attractive by tax rebates that account for a substantial portion of the overall installation costs. This rebate could account for as much as 40%-50% of the total cost, depending upon the state. California’s high demand for electricity has necessitated a generous renewable energy rebate program and it is currently the leader in state rebates. A listing of each state’s economic incentive programs for renewable energy is accessible on the Database of State Incentives for Renewables & Efficiency (dsireusa.org), which is published by North Carolina State University.

On a more global basis, Germany is the world’s leading user of solar collection systems for the generation of electricity. This is not because Germany is a location with an abundant amount of sunlight; in fact it receives the same amount of sunlight as Alaska. Instead, the Germans were proactive in developing a system to decrease dependence on traditional sources of energy, and have implemented a leading financial rebate program for renewable energy.

Cost of Electricity

The decision to invest in a solar collection system is directly impacted by the current cost of traditional electricity and recent rate increases. As of the end of 2007, the national average cost for electricity across all sectors (residential, commercial and industrial) was 8.91 cents per kilowatt hour (kWh). Idaho had the lowest average (5.20 cents p/kWh) while Hawaii had the highest average (25.21 cents p/kWh).

Conclusion

Environmental and political circumstances have led to increased awareness and consideration of sources of renewable energy. This, in turn, has created an increased demand for available funds in order to gain access to these new energy sources. As with any financial venture there will always be a certain amount of risk, and each lender must determine whether or not this risk is acceptable. But as electricity costs and demand continue to increase, the application of solar technology becomes much more attractive and desirable to companies looking to reign in energy and operating costs.

No tags available