The survey was conducted during a period of increasing uncertainty about the health of the U.S. economy (August-October 2007) due to a combination of federal fund rate cuts and substantial loan write-downs. Despite the influence of these factors, the responses given were generally consistent over the course of the survey interviews.

The good news from the 600 CFOs who were asked their opinions on the economy, financing, M&A activity and their involvement in foreign markets, is that seven out of ten expect their company’s revenues to increase in the coming year — and nearly half (45%) predict increased profit margins.

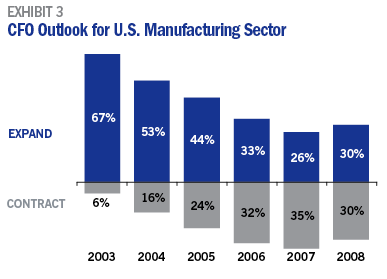

But, the news doesn’t get much better from there. While CFOs are optimistic about the prospects for their own companies, they are concerned about economic expansion and growth opportunities for the manufacturing sector in 2008.

While down slightly from last year’s score of “67,” manufacturing company CFOs view the current state of the U.S. economy in a positive light, giving it an average score of “64” on a scale ranging from 0 (extremely weak) to 100 (extremely strong). A majority of CFOs (58%) believe the actions taken by the Federal Reserve Board have helped the economy.

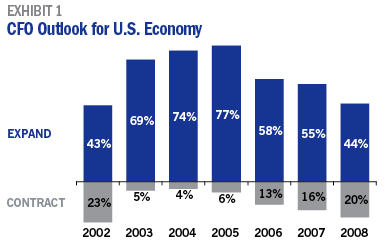

However, when asked about their economic outlook for 2008, only 44% of respondents believe the national economy will expand, the lowest average score in six years, and a significant decline from the all-time high of 77% cited in the 2005 CFO Outlook. (See Exhibit #1 — Outlook for U.S. Economy). What’s more, only 22% of CFOs expect the U.S. economy to outperform the world economy next year, down significantly from 39% in last year’s survey. Nearly six out of ten CFOs (59%) are hopeful that the Federal Reserve Board will come to the aid of the economy by cutting rates next year.

Manufacturing Sector

CFOs are generally positive about the state of manufacturing over the past 12 months. When asked, “How would you rate the current state of the manufacturing sector on a scale of 0 (extremely weak) to 100 (extremely strong)?” the average score was “59,” a score that has remained the same for the past three years.

M&A and Global Expansion

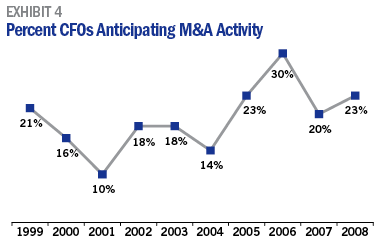

Expectations for merger and acquisition activity were slightly higher than last year (23% versus 20%), but still considerably less than 30% two years ago. (See Exhibit #4 — Anticipated M&A Activity). That’s in spite of an anticipated decline in the price of acquisitions with only 21% of CFOs expecting acquisition targets to go for a higher multiple of earnings in 2008. Likely due to a tightening credit market, the percentage of CFOs who believe there are more businesses available at lower purchase prices has climbed to 29% from 23% last year and 20% the year before.

Growth in international trade is again expected primarily in Asia (57%) and Europe (54%), with significant increases expected in both Latin America (36% versus 19% last year) and Canada (25% versus 11% last year). Seventy-one percent of companies selling to foreign markets expect their sales to increase compared to 64% last year. This isn’t surprising considering the declining value of the U.S. dollar against foreign currency.

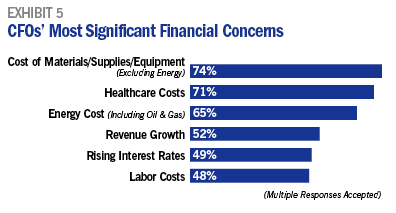

Seventy-four percent of CFOs surveyed consider materials and equipment to be their number-one cost concern. This was down from 84% last year, but still holds the top spot. This was followed closely by the cost of healthcare at 71%, and energy prices at 65%. (See Exhibit #5 — Financial Concerns).

Slower Spending

The outlook for capital expenditures has weakened somewhat with only 32% of CFOs indicating that their capital expenditures for next year will be higher compared to 38% last year. Twenty-seven percent of CFOs expect to spend less or refrain from making capital expenditures altogether in 2008 compared to 21% last year. This correlates with the uncertainty about the direction of the U.S. economy.

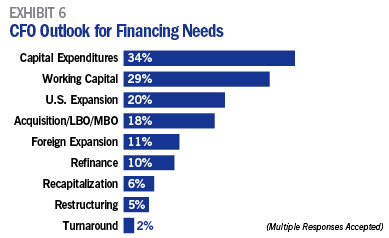

Fifty-eight percent of CFOs expect to borrow money for a variety of purposes, including capital expenditures (34%), working capital (29%), U.S. expansion (20%) and acquisitions (18%). (See Exhibit #6 — Financing Purpose). They also expect to use a variety of financing sources, with internal funding (59%), cash-flow financing (42%), asset-based lending (38%) and leasing (33%) mentioned most frequently. Credit is still plentiful. Thirty-five percent say the availability of credit from their lender has increased during the past 12 months and 50% say it has remained the same.

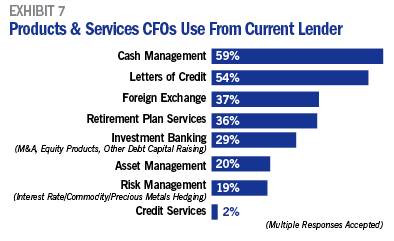

The bank products used most frequently by CFOs include cash management (59%) and letters of credit (54%). These are followed by foreign exchange (37%), retirement plan services (36%) and investment banking (29%). (See Exhibit #7 — Products and Services from Current Lender).

Within these banking relationships, CFOs report that the most important factor by far in their consideration of senior financing is the lender’s willingness to work with them during good times and bad (See Exhibit #8 — CFOs’ Most Important Considerations for Senior Financing). Effectively meeting their credit needs and a lender’s ability to provide a wide range of commercial products round out the top three considerations cited by CFOs.

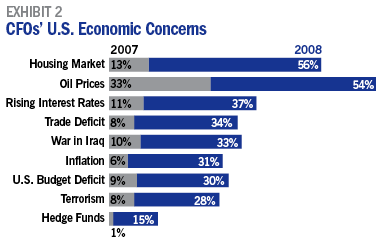

The results of the Bank of America Business Capital 2008 CFO Outlook illustrate that manufacturers are increasingly cautious about the future of the U.S. economy and the manufacturing sector due to a deteriorating housing market, higher energy prices and a host of other factors. Nevertheless, with a positive outlook for revenue and profit margin growth, manufacturers continue to be hopeful. By looking for ways to grow revenue outside of the U.S., they also remain resourceful. Indeed, many manufacturers are taking the steps necessary to succeed in an increasingly competitive and global economy.

Joyce White is the president of Bank of America Business Capital. For more information, or to download the entire report, visit www.bankofamerica.com/businesscapital24

Joyce White is the president of Bank of America Business Capital. For more information, or to download the entire report, visit www.bankofamerica.com/businesscapital24

No tags available