Monitor: It seems that a robust U.S. market and growing demand from overseas are combining to send business jet sales to record heights. Are you currently able to take advantage of the growth in foreign markets? In addition, are there significant jurisdictional differences that require additional resources or skill sets?

Michael Amalfitano SVP, Banc of America Leasing, Corporate Aircraft Finance

Michael Amalfitano SVP, Banc of America Leasing, Corporate Aircraft FinanceMichael Amalfitano: That’s a great question. The short answer is yes. We are positioned as a global bank and with our presence in the UK, we can take full advantage of our global initiative. A product that has the greatest capability of doing so is our Residual Value Guaranty (RVG) product. RVG allows us to have a much broader global reach due to a skill set that most foreign banks don’t have — and that is residual value asset management, and the strength and knowledge required to know what to do with an airplane. RVG can really help grow a book of business in international markets.

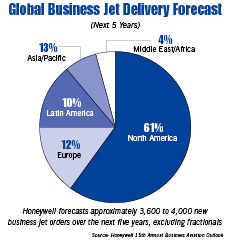

Are there jurisdictional differences? Absolutely … business overseas is done differently. There are a lot more intermediaries and there are more tax, legal and regulatory constraints. In addition, there is less infrastructure in place in certain markets and we have to adapt and build out. But it’s nice to know we have a bank with an international presence that provides us with leverage. We have a strategy that includes Europe, Middle East, Asia and Africa and, right now, our strategy is prime for that growth.

M: Is your strategic relationship with Jet Aviation Holdings a critical component of your global reach?

These companies are critical to growing out of any market because they are touching clients who own aircraft, they are managing those aircraft for those clients and they are a very good source of opportunity for us as it relates to financing those aircraft. The same holds true for them — we, too, have a large client base, so it is a good reciprocating relationship for both of us.

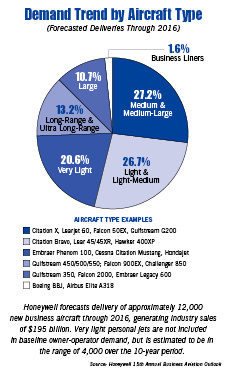

M: Honeywell’s business aviation outlook (end of 2006) forecasts deliveries of 12,000 new business aircraft over the next decade worth $195 billion — 25% higher than the 10-year sales forecast issued by the company at the end of 2005. Would you say over that six months, this forecast was overly aggressive or conservative and why?

MA: It’s interesting … Honeywell is one of several companies, including The Teal Group and Rolls Royce, which provide these 10-, 15- and 20-year looks at the industry. Most recently, EMBRAER also started to provide its market outlook. And I would say that not one of those companies could have predicted the robust growth the OEMs have experienced in business jet aviation that has taken place in the past 18 to 24 months. These manufacturers have backlogs that are out to 2010, 2011 and 2012 on most of their production line, most notably their high-end large cabin aircraft. So, I think they’ve done a great job on their forecasts based on the information they had at the time — and I would continue to place a great deal of credibility in the work these companies put into their forecasts.

The hard part is continuing to forecast the anticipated growth that is not easily seen and the sustainability of that growth. What has made the growth so much more robust — forecast period over forecast period — is the way OEMs have responded with the kinds of new generation product to attract new buyers.

M: It’s also been posited that even if the U.S. economy cools and there’s a small downturn, continued robust demand overseas would offset it by keeping opportunity levels at or above historical levels. For purposes of sustainable growth, I guess it all depends on how you view the risk/reward model for the U.S. versus Europe, Asia, the Middle East, etc. Can you comment on this?

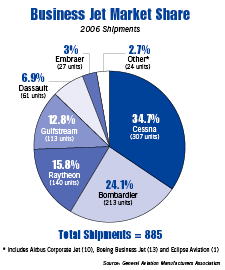

MA: It’s an interesting question. We see a lot of data right now about the growth of the global market and how much of the OEM production is going to overseas demand. If you went from manufacturer to manufacturer, you’d see percentages that are north of 50% and some higher depending on the aircraft cabin class. Folks are only talking about the growth of this new market. What’s interesting though is that they aren’t talking about the whole pie. The pie itself has gotten bigger. The U.S. is growing just as much as the foreign marketplace. Maybe in the past you saw a 70% to 75% U.S.-based market and now it might be 60% to 65% U.S.-based, but it’s a 65% base of a much bigger market. In the end, I guess I don’t believe there’s going to be that “cooling off” period because the U.S. is just as robust as it’s ever been.

M: What’s your sense of the opportunity represented by advent of the “very light jet” into the general aviation space? We’ve seen forecasts that say deliveries of 5,000 VLJs, with a list price below $4 million, are projected over the next decade. Is this an incremental market opportunity for Bank of America. If yes, can you comment?

MA: I’ll start with the second question first because it speaks to our strategy at Bank of America. Very simply, yes, it is something we can take advantage of because the buyers are going to be individuals who are moving up from the turbo-prop market into the entry-level jet market. Those types of high net worth individuals fit very well with our wealth management strategy so we think there will be even more overlap as it relates to that client-type profile.

In regard to the big picture for the VLJs, we have programs in place with three of our alliance partners. One dates back to our Cessna Citation Finance Program for all of their Citations and, of course, the Mustang will now be added. The newer alliances we’ve announced are with EMBRAER on the Phenom 100 and 300 products and the other is with the Eclipse 500. We are working basically with those three. While there are many more manufacturers out there trying to make a very good product fitting into the emerging VLJ sector, we think these three are the ones that are going to give us the most client lift — and we market our products based upon what fits best with our client’s needs when it comes to Bank of America’s strategy.

In terms of the specifics of the deliveries, you have to ask yourself, “Do you believe in this air taxi phenomenon?” If you do, then you’re going to see thousands and thousands of units. But, we’re not focused there as our reason to be in this market. It’s much more about the asset, and we are asset-focused. This aircraft type has a unique market and a buyer profile type that fits with Bank of America’s strategy — that’s why we’re focused on it. We aren’t focused on it because we think it’s such a huge growth area — again, it’s mainly about wanting to service our clients.

M: Could you comment on the end-user profile of a typical business aircraft finance or lease customer. For example, do you find in actual practice that the user tends to be a high net worth individual versus a corporate or business aircraft operator? Have your ties to Bank of America’s Private Bank enhanced your ability to do business with wealthy individuals?

MA: About 50% of the business comes from our high net worth and ultra high net worth clients with the affluence to purchase assets like business aircraft. The other half comes from the corporate marketplace. That fits very well for Banc of America Leasing and how it incorporates itself with its business partners internally as a partner of choice. On one hand we have Private Wealth Management working with high net worth individuals and on the other hand we have Global Commercial Banking and Global Investment Banking dealing within the corporate sectors. So, we dovetail very nicely with the rest of the bank and its clients, and the profiles we see tend to be in the 50% to 55% range being high net worth over corporate clients, depending on the year. That should stay consistent as we continue to grow.

I think that you’ll start to see larger companies and wealthier individuals as these assets continue to grow in purchase costs, just as they’ve been doing over the recent years, and it’s going to be interesting to see how the end-user profile changes in the long term. That should give your readers some perspective on how we go to market internally to leverage the bank’s overall client growth strategy.

M: Then it must go without saying then that your ties to the private bank have enhanced your ability to do business in the market. Would you agree?

MA: It’s an integral part of our strategy because our wealth advisors deal with clients who have needs in terms of their investments, retirement as well as tax and estate planning. At the same time these individuals have capital they need to invest in their business and we can introduce them to our commercial bank partners. We are oftentimes the lead product. Our wealth advisors like dealing with Corporate Aircraft Finance within the leasing business because much of the time we are the “door-openers” to gain access to these clients through these business jet financing opportunities. We bring the client into the bank and the bank surrounds that client with the other value-added products offered through Private Wealth Management.

M: Back in mid-July 2004, Bank of America noted it was a leader in the corporate aircraft market with more than 700 clients and $4.5 billion in aircraft loans and leases. Fast-forward three years: How would you dimension your position in the GA marketplace today using the same criteria?

As far as looking forward, we have very lofty revenue goals and very robust growth goals in all of Bank of America’s businesses — and business aviation is no exception. We are going to be a leader in this space for many years to come and the reason is that we’re structured correctly: we have in-house asset expertise and we have experienced leasing professionals, tax professionals and aviation experts all on staff. We’ve built a vertically integrated niche within the powerhouse of Bank of America, which positions us for unending growth. As long as the general aviation market continues to grow, we can capture every bit of the growth that’s there based on our dedicated infrastructure.

M: We noticed that Bank of America recently announced entrance into the helicopter finance and leasing marketplace. Can you give our readers a sense of the size and scope of this market in the U.S. and why Bank of America decided to commit to build a business in this segment?

MA: It’s an interesting dynamic. As we continued to be a leader in business jet aviation and corporate aircraft, we started to see clients who were buying more than just fixed-wing aircraft. There were select strategic client decisions being made when they started buying rotary-winged products. It was much more about a client niche versus a decision to jump into this industry called helicopters. In order to do it right, we did it the same way we approached the fixed-wing marketplace — you’ve got to find the right people first.

When we entered this market we realized we needed to employ a “top down” business model to be strategic with our client selection. We knew we weren’t going to be providing helicopters to all operators. In doing so, we started working with the top four OEMs on the ships they sell. In turn, they started to mirror the fixed-wing manufacturers and have started introducing new products. Our experience told us that new generation products have always meant success for the fixed wing marketplace. We realized this was another reason to enter.

One final point: when we started talking to the OEMs, it was clear they needed a fresh perspective. There was no large bank that had any real presence in financing helicopters … it gave us the opportunity to see it as the perfect time to step in stragetically.

M: How is your Corporate Aircraft Finance unit viewed within the Bank of America leasing business — can you share relative performance metrics?

MA: I can give you one metric — we’ve experienced 47% growth in origination production over this time last year and that growth is going to continue. And those kind of growth percentages are welcomed within Corporate Aircraft Finance, Banc of America Leasing, and by Bank of America overall. We are viewed strongly within our footprint and I see that growth continuing.

M: One last question — what keeps you up at night? Or what is your greatest concern with regard to the future of the business aviation market and your role in it?

MA: It’s explained the easiest by looking at it from the perspective that growth means you are not only doing more business, but you are also taking market share. One of the things that is always of concern is when you’re trying to balance growth and protecting market share from some of what I call irrational competition that has entered the space.

As with any market with a lot of activity that’s performing well, new people enter it and try to take a share of it. Those that don’t have the expertise and the depth may not have the same approach that we do. As a result, we see some irrational behavior from our competitors. What keeps me up is the question: “How do you balance growth goals while protecting your market share from those irrational decisions you have to face in dealing with the day-to-day competition?”

M: Thank you for your time and insight.

MA: You’re welcome.

No tags available