Rita E. Garwood,

Editor in Chief,

Monitor

Activity in the vendor channel was back in full swing in 2021. The top 40 companies reported a collective $45,684.6 million in vendor channel originations in 2021, up $4,491 million (10.9%) from $41,193.6 million in 2020. Once again, the top three companies held on to their positions, while the rest of the rankings experienced some shifts.

Of the group, 33 companies posted net year-over-year increases totaling $5,144.1 million in vendor activity, while seven posted declines equal to a combined $653.2 million, which resulted in a net increase of $4,491 million for the entire group.

Top Five

DLL maintained its standing as the top company in the vendor finance channel with $13,363 million in vendor channel originations, up $1,189 million (9.8%) from $12,174 million in 2020. Wells Fargo Equipment Finance held on to its No. 2 position with $6,838 million originated in the vendor channel, an increase of $285 million (4.3%) from the $6,553 million reported the previous year. Despite a small decrease in vendor activity, Bank of America Global Leasing checked in at No. 3 once again with $3,142.5 million in vendor volume, down $116.8 million (3.6%) from the $3,259.3 million recorded in 2020. Climbing up a notch to No. 4 on the power of a 14.6% increase was U.S. Bank Equipment Finance with $2,818.2 million originated in the vendor channel, up $358.1 million from $2,460.1 million the previous year. PNC Equipment Finance dropped to No. 5 in the ranking with $2,756.7 million in vendor volume, down $235.9 million (7.9%) from $2,992.5 million in 2020.

Top Dollar Gainers

No. 1-ranked DLL achieved the highest dollar gain of $1,189 million, bringing its total vendor volume to $13,363 million for the year. U.S. Bank Equipment Finance, ranked No. 4, charted the second highest increase of $358.1 million, which helped it move up a notch in the ranking. Coming in third was People’s United Equipment Brands, which upsized its vendor volume by $324 million, bringing the grand total of its vendor channel originations to $1,412.4 million. Amur Equipment Finance, ranked No. 15, had the fourth largest gain at $322.4 million, which brought its total vendor volume to $607.5 million. Meanwhile, No. 2-ranked Wells Fargo Equipment Finance had the fifth largest year-over-year increase at $285 million.

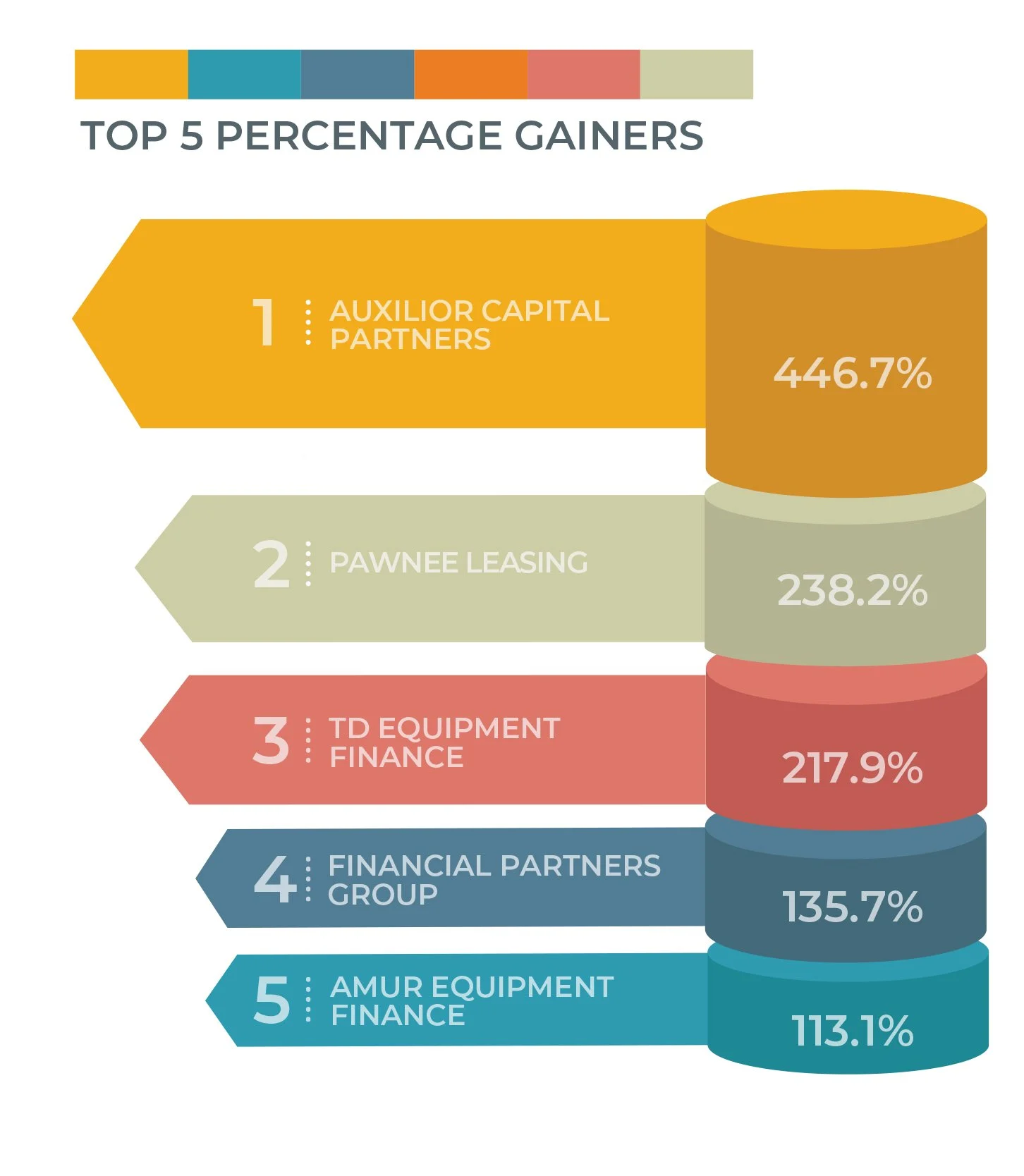

Highest Percentage Increases

New to the vendor ranking this year, Auxilior Capital Partners, which ranked No. 40, achieved the highest percentage gain (446.7%), increasing its annual vendor channel volume to $117 million, a $95.6 million increase from $21.4 million in 2020. Pawnee Leasing, which ranked No. 30, recorded the second highest percentage gain (238.2%), bringing the total of its vendor activity to $209.7 million, an increase of $147.7 million from $62 million the previous year. No. 19-ranked TD Equipment Finance came in third when it came to percentage gains, charting a year-over-year increase of 217.9%, which elevated its vendor volume to $346.8 million, up $237.7 million from $109.1 million in 2020. Claiming the fourth largest increase (135.7%) was Financial Partners Group, which ranked No. 21 overall and completed $330 million worth of deals in its vendor channel in 2021, $190 million more than it achieved the prior year. No. 15-ranked Amur Equipment Finance was the final company to more than double its prior year vendor volume, recording an increase of 113.1% ($322.4 million), which helped the independent amass $607.5 million in vendor originations.

Segment Composition

The U.S. Bank Affiliates continued to dominate the vendor channel, with 24 banks contributing $26,541.2 million, or more than half (58.1%), of the vendor originations recorded by the top 40 companies. The four Foreign Affiliates originated $15,149.5 million (33.2%) of the group’s total, while the 11 Independents accounted for $3,711.5 million (8.1%) and the one Captive added the remaining $282.3 million (0.6%).

New Arrivals

Rejoining the ranking this year after a brief absence were No. 8-ranked CIT, a division of First Citizens Bank, and No. 15-ranked Amur Equipment Finance. New to the ranking this year due to acquisitions were No. 9-ranked Huntington Asset Finance, which acquired TCF Capital Solutions (ranked No. 8 last year), and No. 14-ranked Mitsubishi HC Capital America, which acquired Hitachi Capital America (ranked No. 12 in 2020).

Five companies also joined the ranking for the first time this year:

• Farm Credit Leasing, ranked No. 20, with $332 million

• Pawnee Leasing, ranked No. 30, with $209.7 million

• Signature Financial, ranked No. 33, with $160.8 million

• MMP Capital, ranked No. 34, with $148.3 million

• Auxilior Capital Partners, ranked No. 40, with $117 million

Departures

Truist Equipment Finance, ranked No. 20 last year, reported a significant decrease in 2021 vendor activity, the amount of which was not enough to make it into the top 40 this year. Baystone Government Finance/KS State Bank ranked No. 30 last year but did not respond to our requests to complete our annual survey. Meanwhile, Merchants Bank Equipment Finance, Northland Capital Financial Services, Wallwork Financial and Lease Corporation of America, ranked No. 34, No. 36, No. 38 and No. 39 last year, respectively, made it into the top 50 companies this year but did not record enough vendor activity to make the top 40.

Conclusions

The vendor channel bounced back in 2021, recording the highest percentage gain since 2013. The majority of the group (82.5%) reported positive growth in vendor originations, while 17.5% experienced declines. The space experienced some shifts in 2021 due to a flurry of acquisitions while new entrants continued to enter the fray and take market share.

We thank the companies that participated in this year’s vendor ranking, as this annual event would not be possible without their cooperation. We also remind our readers that this is the last issue before our annual Monitor 100 list, which will be coming up next month.

Basis for Rankings

The rankings and data in this report were derived from equipment finance companies, which provided information on funded 2021 volume from vendor- and/or dealer-related relationships to qualify for inclusion in the vendor channel rankings. Many Monitor 100 participants originate new business volume from more than one source, but this aspect of our annual rankings is unique to the vendor channel.