Scott Nelson, PHD,

President & Chief Digital Officer,

Tamarack Technology

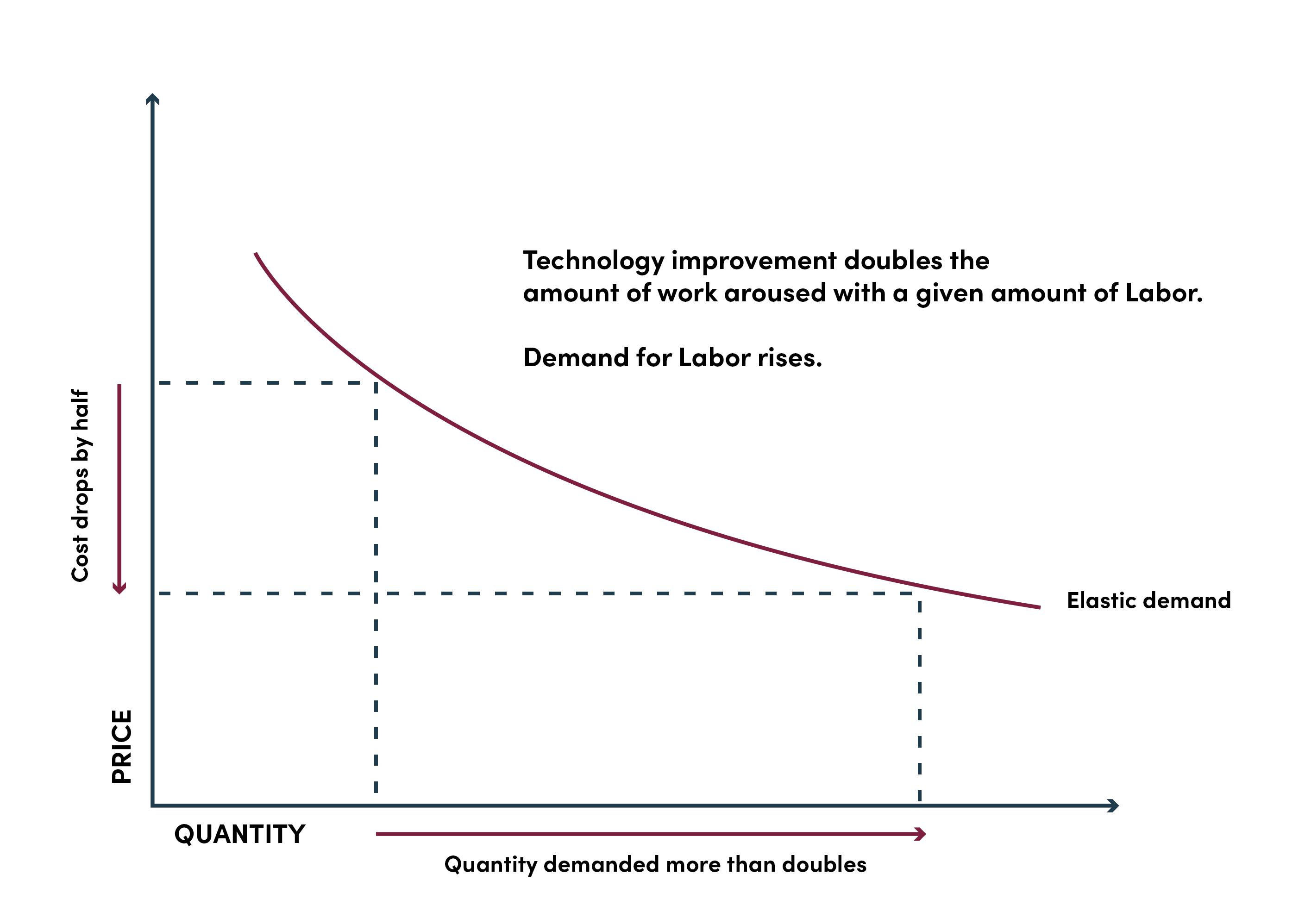

In 1865, William Stanley Jevons, a young English economist, observed the effect of productivity and efficiency on the consumption of coal in manufacturing processes. James Watt had recently introduced his steam engine and some economists were forecasting an end to the worsening pollution as the efficiency of Watt’s new engine reduced the amount of coal burned for any given task. Jevons saw things differently. He overlayed resource efficiency on the supply and demand curve, noting that as efficiency reduced the cost of production from the use of a given resource, the market would increase demand for that resource. Jevons forecasted correctly that coal pollution would increase because of Watt’s new invention. Even though the steam engine was more efficient, that efficiency created more demand and in turn, more pollution.

At its core, Jevons Paradox prescribes that “long term, an increase in efficiency in resource use will generate an increase in resource consumption rather than a decrease. To date energy efficiency has dutifully followed the paradox — the more efficiently energy is produced, the more the energy is consumed. Like Moore’s Law, which 100 years later (1965) stated that the size and cost of a transistor will decrease by a factor of two every two years, Jevons Paradox is one of those “insightful observations” that, while not mathematical or canonical in its derivation, is persistent in its accuracy.

Fast forward 150 years to an emerging trend in business brought on by the confluence of both Moore and Jevons. One of the most visible results of Moore’s Law today is the affordable ease with which AI can now be applied to business processes across almost every global industry. For example, low-cost cloud computing and storage have been augmented by machine learning and AI tool chains to make AI-based automation affordable and practical. But, AI is often seen as a more efficient form of human intelligence leading some to foreshadow that AI will reduce the need for people in professions like medicine, engineering and finance just as their like-thinking counterparts forecast a reduction in the need to burn coal in 1865 England. However, Jevons’ economic theory forecasts the opposite — AI technology will drive human productivity improvement that will create more demand for human capital, not less. This means that industries like equipment finance are going to need hire if they want to take advantage of AI and keep up with competition. Let’s take a closer look at how and where this will happen.

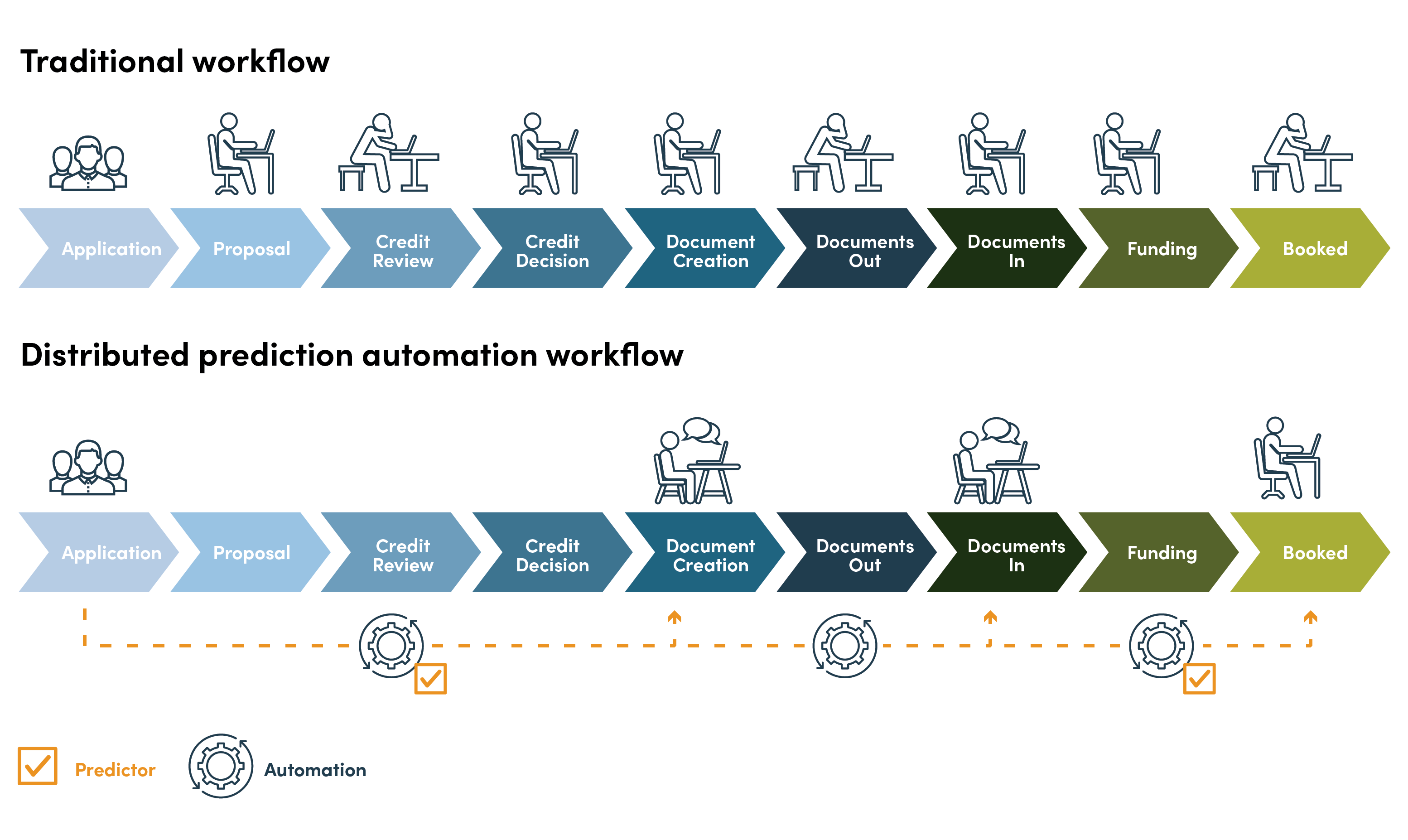

Consider the traditional origination workflow shown on the top of Figure 1. Each step of the process uses human interaction as the workflow moves from one step to the next. Human touches and prerequisites can slow down or interrupt the process when people or specific data are missing from the process. However, when machine learning is applied to historical data from this process and combined with portfolio performance data, AI can predict outcomes and automate processes where humans typically needed to be involved. As you can see in Figure 2, AI and automation can take the place of human touches to complete steps in the process and improve the productivity by increasing the volume of deals that move through the workflow.

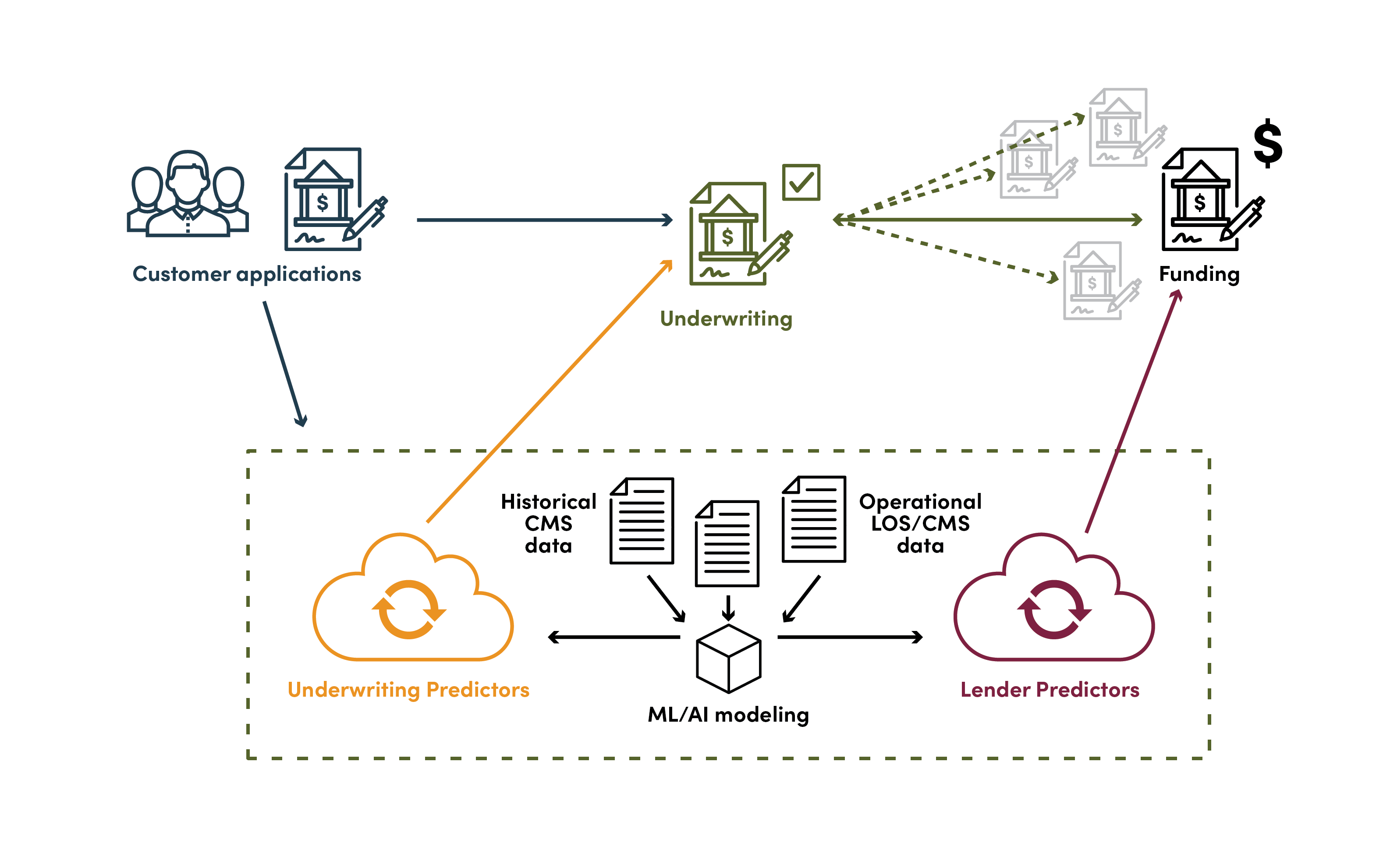

As an example, prediction automation can become the basis for the deployment of quantified risk policies, as shown in Figure 3.

Predictors can automatically process, underwrite and fund deals that fit the chosen policy parameters. Deals outside the defined parameters are still evaluated and completed by humans, but the AI can provide recommendations and insights to accelerate the manual processing of the deals.

A real-world example of an organization using AI to enable risk policy automation has seen an increase in efficiency when reviewing deals that fit certain performance expectations and also improved the review process of more complicated deals through the use of AI recommendations and business intelligence from historical data. Some of the results seen over the first nine months when using the AI platform include:

These results reflect the true impact of Jevons economic theory. Note the organization did not hire additional resources to achieve these productivity improvements, nor did it reduce the number of roles inside the organization. In fact, it is now aggressively hiring in multiple roles across the organization. The first, and perhaps most obvious, management response is, “If I can process deals almost twice as fast without increased risk, I need to hire more salespeople.” This is true and when the traditional origination workflow was overlayed with time in stage, bottlenecks in documents and lender management were impacted. Indicating that there was an opportunity to increase overall production and justified the hiring of those new roles. The 38% increase in revenue per head combined with process time in stage data gives management confidence in hiring for those specific parts of the workflow.

Greg Ip of the Wall Street Journal described how the introduction of VisiCalc, Lotus 123 and Excel spreadsheet applications in the 1980s decreased the demand for bookkeepers by 44%, but the need for accountants, auditors, financial managers and management analysts increased by almost four to one. When technological efficiency reduces the resource cost per unit output for a given process, it has persistently increased the demand for those or similar resources to meet the increase in overall output. AI continues to bring efficiency to equipment finance; the more efficient application processing and underwriting becomes the more capacity and demand the enterprise has for new business. Some within equipment finance will automate applications; others will hire aggressively to take advantage of the efficiencies created by AI and build more relationships. The discussion regarding “this is a relationship business” versus “all digital” will intensify over the next few years as the efficiency of underwriting increases and organizations make changes to take advantage of the new opportunities afforded by AI. But whichever approach is taken, more people will be needed.

AI is increasing the productivity of people and processes in equipment finance. As Jevons predicted, industry growth and hiring are already well underway. Those just getting started with AI should plan to use any money saved to hire recruiters if they want to keep up.

Scott Nelson is the president and chief digital officer of Tamarack Technology. A well-recognized expert in technology strategy and development including Internet of Things (IoT) connectivity, Nelson leads the company’s efforts to expand its impact on the industry through innovation with new products, system level thinking and the application of new technologies with a design thinking methodology. In his dual role at Tamarack, Nelson is responsible for the company’s vision and strategic planning as well as business operations. He has more than 30 years of strategic technology development, deployment and design thinking experience working with both entrepreneurs and Fortune 500 companies.

No categories available

No tags available