What’s your AI fitness level? Scott Nelson explores three levels of AI fitness. If you’re a beginner, your AI fitness journey must start with data consolidation before you can move on to data assessment and performance.

Most aspirational 2024 New Years’ resolutions have fallen by the wayside leaving only those that are critical to mission and well-being. In equipment finance, Engaging AI in 2024 is one of the latter, not the former — making it a critical strategy for this year and beyond.

AI “celebrity” heavyweights like Microsoft, Google and OpenAI are still running infomercials announcing new AI gadgets, but just like most get-fit gimmicks, the mystery of the fitness routines of the AI ultra-fit fail to help small business leaders who tend to leverage simpler solutions to solve traditional problems like poor customer service, low productivity and lack of a competitive advantage.

But there are early adopters from this small business group in equipment finance who have an AI-fitness foundation that makes leveraging AI an easier lift. First, these early adopters have already consolidated their data and built data-centric cultures. They further developed their AI-fitness by assessing business performance through data analysis and finding business outcomes that needed to be improved. Some are now advancing performance to the next level by driving better outcomes faster with AI. These AI adoption leaders have built data-first cultures that push past the “I can’t do this” phase and are moving forward to higher levels of AI fitness.

AI Fitness Level 1: Data Consolidation

Everyone knows that AI is all about data, but most are not sure where to start because their data is all over the place and in all different forms. They have bad data habits. For equipment finance companies, this is the biggest problem when engaging AI: their data is not in the same place and it’s not ready to be used.

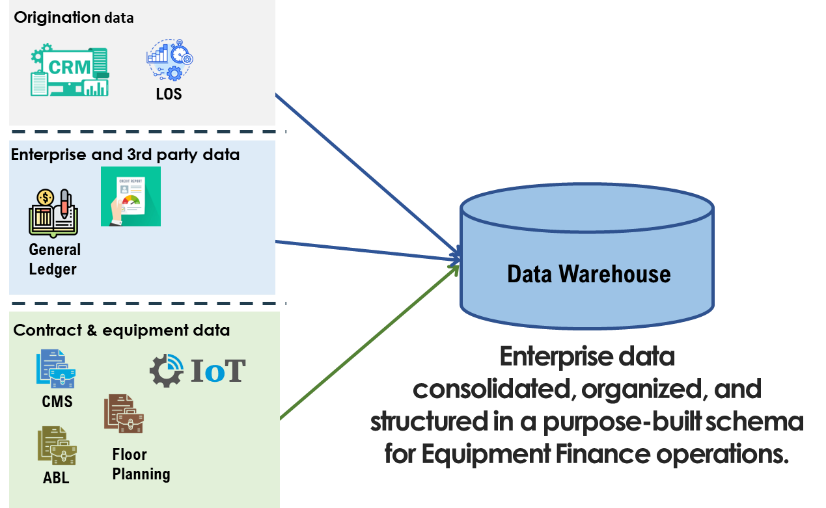

Both accessing and trusting data is challenging. Legacy systems require custom integrations and newer systems have interfaces that, while modern and appropriate, are not compatible with legacy systems nor familiar to IT teams. Disparate systems — CRM, LOS, CMS, ABL, GL, and external sources of information — are integrated with manual effort, custom code and spreadsheets all of which introduce opportunities for error. Building AI agents from spreadsheets is more than a bit difficult and trusting disparate data sources is even more difficult.

Early adopters are those that have been collecting their data with a belief in its future value and an expectation of rewards from using that data. Even when analyzing the data manually — via spreadsheets — they felt compelled to consolidate and engage with the data.

So, the first step towards AI fitness is consolidation — having all your data in one place where it is organized and structured-for-purpose. Disparate systems and the resulting difficulties with data integrity prevent many equipment finance leaders from breaking their bad data habits and becoming AI-fit.

The hesitant should note: this first step gets harder and harder each year as more and more of your data goes dark.

AI Fitness Level 2: Data Assessment

Once a foundation of consolidated data is established, the business can focus on assessing its performance and analyzing outcomes using that data. The early adopters of AI are naturally curious and have business intelligence systems that can answer business questions. They are curious about how they can improve operations and performance, so they dig into their data using analytics with two questions:

For many these questions are harder to answer than one would expect. But Agarwal et al., simplified the first question in Prediction Machines and instruct AI users to ask themselves “What is our prediction problem?” Which outcome do we wish we could predict so that our business would be safer, easier or more profitable?

One obvious answer in equipment finance is “I wish I knew if this borrower were going to make all their payments.” Others might be “I wish I knew if this borrower is going to ask for an early payout” or “I wish I knew if this borrower would renew.” Perhaps Agrawal’s most important teaching is this, “What is your prediction problem?” construct.

The next question — “What is the quality of our data?” — can be intimidating for the AI-unfit. They don’t know where their data is and often the same information is coded in different formats or definitions. Trust in the data is often a showstopper. But those with data fitness already have beliefs about which data is critical to important decisions and so they have collected and organized it for a purpose. They also have multiple scorecards built for that data and update the cards regularly. They persistently investigate and are naturally skeptical of data integrity. As a result, they are creative in how data is gathered to answer the business’ questions. A big advantage for them is that the machine learning tools now available in most cloud ecosystems don’t care if a model training process begins with five inputs or 500. In fact, the process of assessing business data is automated by the AI training process as it starts with all the data available, sometimes hundreds of inputs, and then aligns or removes those that do not help predict outcomes. The process filters and intensifies the value of the data, both historical and ongoing.

In some ways, natural curiosity and modern machine learning technology make this stage of AI fitness development one of the easier ones. Like drinking a chocolate protein shake after a hard workout.

AI Fitness Level 3: Data Performance

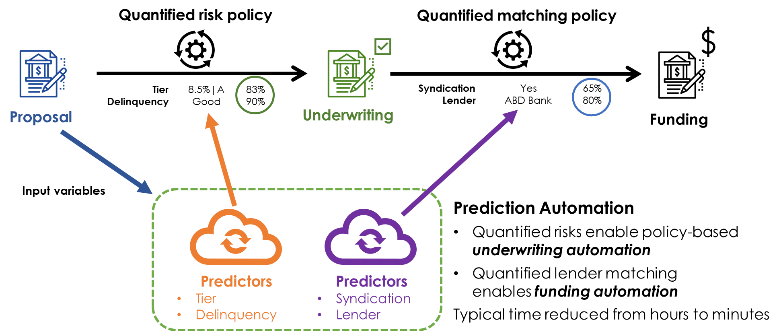

At this point, early adopters have an AI fitness foundation in place, and they have begun daily routines of data analytics and investigation. Early adopters are motivated by the need to improve and understand how AI fitness training will help them achieve their goals. They can see, through these investigations, that integrating outcome predictors into a workflow will accelerate both the pace of the business and its impact on their goals. Figure 3 shows how a combination of underwriting and funding predictors built with quantified risk policies can automate the origination workflow. Days or weeks can be reduced to minutes when predictors automate decision making and advance operational performance to a new level.

But automating decisions is an advanced fitness exercise for most businesses. Developing the trust necessary to allow software to make decisions traditionally assigned to trained employees takes time and repetition. Again, the fitness metaphor is valid here because the way to develop this trust is to build predictors and exercise them in parallel with the manual workflow to ensure they perform as expected. This helps the organization learn how to safely deploy AI automation.

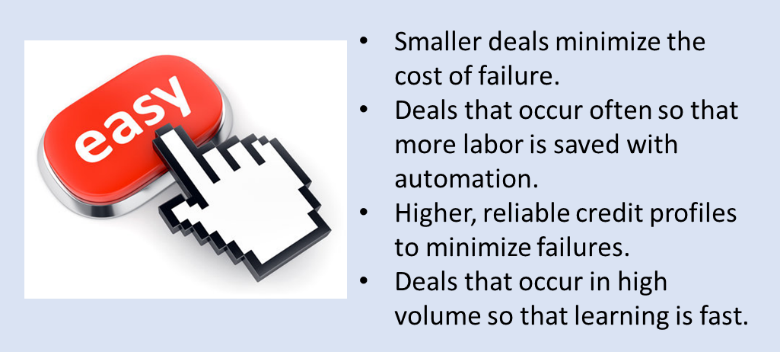

Safe is the key word here. The fastest way to learn is often by learning from mistakes, and AI is no different. But mistakes can be painful, so early adopters apply AI decision making to “the easy stuff” first. Learning with the “easy stuff” reduces the risk of failure and maximizes the savings via automation because the easiest deals are often also the most frequent. The business runs faster, learns faster and produces faster results when these deal streams are automated with AI. Employees are freed to work on more complex problems, further improving performance, driving long-term value and creating higher productivity across all workflows.

The playing field for AI is wide open and, while not crowded yet, the AI fit are making their move. They are following a simple AI fitness routine — consolidating and assessing data followed by advancing performance — to engage AI to be more competitive and better serve customers. These leaders trained and built data-centric cultures that constantly ask questions about how to get better. The early adopters will soon be apparent through faster growth and the competitive agility that comes from faster learning.

The AI fit will become the most competitive on the equipment finance playing field.