We all know the golden rule: Treat others how you wish to be treated. As a core principle of most belief systems, this maxim has been almost universally accepted throughout the ages.

Dexter Van Dango,

Senior Executive,

Equipment Leasing & Finance Industry

Until now, that is. I’ve got some bad news for you — the golden rule is dead.

In today’s hyper-competitive marketplace, equipment finance companies must stand out and differentiate by delivering exceptional customer experiences. And that doesn’t mean one size fits all.

Although it defies the golden rule, customers must be treated the way they want to be treated!

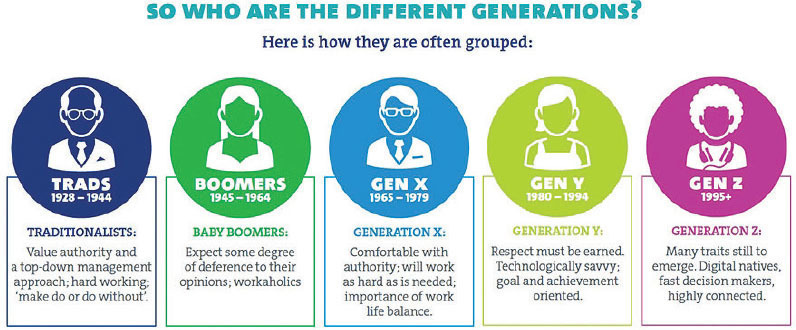

For the past several decades, businesses throughout the world have used the golden rule to define great customer service. Employees quickly learn Rule No. 1 — The customer is always right —and Rule No. 2 — Please refer to Rule No. 1. For the most part, Rule No. 1 still prevails, but the method and means of appeasing a customer will vary immensely, depending on the generation they represent. Delivering great customer experiences to these changing generations will require a transformation of our customer service delivery methods.

Efficient Service with a Smile

Historically, companies created customer service departments to serve the traditionalists generation, and later, baby boomers. Most departments were designed to bring efficiency and effectiveness to a cost center deemed a necessity by industry standards. They were primarily reactive and rarely proactive. A flock of frontline customer service representatives (CSRs) armed with headsets and mirrors mounted on their cubicle walls engraved with “The customer can hear your smile!” staffed toll-free phone lines, responded to invoice inquiries, sent out welcome packages with copies of customers’ executed documents and assumed the role of catchers of oddities from the company’s telephone receptionist.

Productivity was measured by monitoring the number of calls waiting, average call wait times, number of calls received and reconciled and the occasional call escalation process for the customer whose problem simply could not be satisfied by a mere CSR mortal. Employees were often new hires, with little or no business experience, initiated into the business on the frontlines as a newbie CSR.

The Digital Disruption

As customers moved along in their relationship journeys with a company, the digitization of business processes increased their expectations. These changes have led to a transformation of the customer service role. The digital disruption calls for a redefined customer service strategy. Today’s customer service teams are accountable for developing and enhancing the customer’s journey — the overall relationship from beginning to end — and, perhaps most important, for anticipating customer needs.

Improvements in technology have contributed to companies’ abilities to deliver better client experiences using improved delivery platforms. The remaining challenge is to use technology to deliver greater value by giving the customers what they want before they even know they want it — truly anticipating their needs. What began as a new way of interacting with customers through internet- and mobile-connected devices, has evolved into methods for companies to grow stronger, faster and more efficient by building customized client experiences driven by data, agility and interconnectivity.

Just about everyone quotes facts and figures about how critical customer service is in determining customer experiences (CX). The website trackur.com provides a comprehensive list of reminders demonstrating why paying attention to customer experiences is so important:

Examining Your Customers’ Experience

How does your business monitor, respond to, and proactively seek to improve your customers’ experiences with your firm? What, if anything, do you do to anticipate your customers’ needs? At any point in your customer interaction do you ask them, “What do you want? How can I help? How can I make it better?”

Many readers are not providing any of these satisfaction probing inquiries. Instead, I suspect, many use common methods of responding to the typical customer service needs and expectations: a toll-free number printed on customer invoices, an online portal with self-help tools on the company website or maybe even a Facebook page. These are the access points of expectation for traditionalists, baby boomers and many of the Generation X crowd. But what about Generation Y, the millennials? With ranks of more than 76 million, millennials are now the largest group of consumers in the U.S., according to Pew Research. When designing a customer service strategy, considering the power and influence of millennials is crucial.

Catering to Millennials & Generation Z

Millennials are tech savvy and highly self-sufficient. They expect immediate resolution to any customer service problem. Through use of chatbots and other forms of artificial intelligence, millennials expect to use natural language processing systems to explain their complaint, collect any required information or data, and resolve the issue without delay. They expect convenience. Think of it as asking Siri or Alexa to balance your checkbook. Equipped with the right data and intelligence, it is entirely possible. Millennials want hassle-free, accurate and prompt problem resolution, leveraging technology.

To keep up with the expectations of millennials, you will need fully-integrated IT solutions. Your website will require real-time integration with your collections, cash management and accounts receivable systems. If a payment was posted at 10 a.m., it should be reflected on the online portal when a millennial customer checks her account balance. When she logs a complaint about the late fee assessed, an automated bot should generate a response acknowledging receipt of the complaint and promising immediate attention to the matter. Any direct interaction with the customer should be seamless, with all information and history made part of that interaction. There should be no need for the customer to repeat themselves or explain why they are making contact. The entire experience history should be filed as a digital record, alongside the eventual case resolution.

Let’s not forget about Generation Z who are knocking at the door, ready to be recognized as the next serious set of influencers. This generation is currently 17 to 23 years old. Like Gen Y, they are highly self-sufficient and deeply dependent on technology tools. They have a higher percentage of financial independence than earlier generations at the same age. Gen Z members prefer digital interaction to voice or face-to-face. Members of Gen Z have never known analog devices. They embrace the digital wallet and rely on device-specific payment methods like Apple Pay. Their tech fluency is unchallenged. How will you interact with this prominent generation?

To engage this group, you must offer multi-channel access points: a blog, a vlog, a link on your Facebook page, a Twitter account, and of course — your online portal. In a 2017 study conducted by Forrester Consulting, commissioned by American Express, researchers found Gen Z members were “more likely to drop a brand, service or product over poorly designed mobile features (23% to Gen Y’s 16%), slow response times in online chat for sales or customer service (20% to Gen Y’s 17%), or only providing customer service over the phone or in person (12% to Gen Y’s 10%).” Gen Z represents a group who require immediate gratification and are willing to abandon products or services when they fail to add value to the customer journey.

Navigating the Digital Transformation

The digital transformation of the customer experience can be overwhelming. Our industry grew up during the 1970s and 80s and matured in the 90s. We are not Facebook, Amazon, Netflix or Google. Those companies possess extensive digital architectural foundations with application programmable interfaces (APIs) linking systems and databases. Unlike the equipment leasing and finance industry, they are not burdened with disparate legacy systems, relying on overnight batch processing and home-grown customer online portals constructed with band-aids, bailing wire and chewing gum.

So, what is a leader to do?

Finally, entrepreneur Kevin O’Leary, of Shark Tank fame, made a video that is going viral. In it, O’Leary explains the difficult nature of satisfying a customer complaint in today’s ultra-connected, social media-driven world. In his words, “When a customer is unhappy with you, they go online and they go nuts. They go to every website, every service, every rating agency and they go crazy on you.” He goes on to explain the way you respond and handle situations like these is crucial to the protection of your brand and reputation. O’Leary advises, “When someone goes online and goes crazy on your brand, you have to spend time to fix it,” because the public forum in which the interaction is occurring has a huge number of spectators. How you handle the complaint is every bit as much for the benefit of the spectators as it is for the accuser. Another humble reminder that it’s a whole new world out there. Get used to it.

One Reply to “The Next Generation of Customer Service: Serving Clients When, Where & How They Want to be Served”

Dexter,

As always you are right on. The commercial equipment leasing and finance industry is being forced to change. It’s clients (vendors & end-users) are demanding a better buying experience. The question is who will lead the change, who will follow and who will simply disappear.