We can’t remember the last time we rented a car during business travel. Ride sharing is so much easier and usually less expensive. No rental car pickup, parking hassles, hotel valet fees or airport car drop-off. Ride sharing services and hospitality models have dramatically changed the way we think about getting from point A to point B or finding a place to stay.

Sharing economy models, across all industries, are asset light. Uber and Lyft are large transportation companies without owned vehicles, and Airbnb is a huge hospitality company with no rooftops. Rental models and the ubiquitous nature of underutilized assets have been around for a very long time. These technology-enabled business models are different because they overcame the biggest barrier to entry in the rental space — asset ownership — and solved one of the biggest problems — asset underutilization.

Uber and Airbnb Comparison

Uber and Airbnb seem to have a common business model but their growth and profitability have different dynamics. A recent analysis by Battery Ventures, a technology-focused investment firm, highlighted an important distinction between the two.

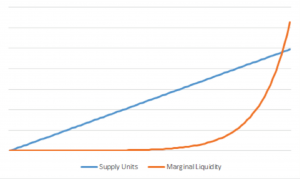

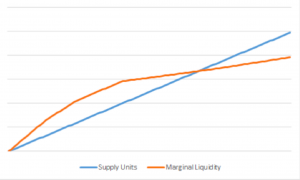

Figures 1 & 2 show the impact of adding supply to marginal liquidity for each.

The contrast is primarily due to the value of global or local incremental supply and whether it is heterogeneous versus homogenous in nature. As Uber expands its fleet, it can reduce prices and wait times but only to a certain point. Adding homogenous supply (rides) to satisfy local needs eventually opens them up to local competition. Uber Pools changes this model somewhat but the overall comparison favors Airbnb.

In the Airbnb model, the marginal profitability increases with supply as its adds heterogeneous room types to meet the price point and preferences of travelers globally. Unlike Uber, Airbnb users need a vast global supply to make the model compelling to use. The article argues “while marketplaces with heterogeneous supply like Airbnb may be difficult to jump-start, they yield increasing returns as their supply increases, which make them incredibly defensible at scale.”

B2B Assets: It’s More Complicated

In B2B equipment finance, the nature of assets is more heterogenous. Though all forklifts handle material and all X-ray machines take images, the vast variety of available equipment and applications in B2B environments make the spectrum of makes and models of any specific asset class exponentially higher than in a B2C transportation or hospitality model. In addition to the plethora of hardware options, business solutions can require careful selection of services, software applications and supply options. This added complexity introduces two additional points of consideration:

Emerging B2B Equipment Sharing Models

Despite some of the higher hurdles for entering the B2B equipment sharing market, new entrants focusing on specific equipment show promise, including Cohealo in health care, EquipmentShare in construction and KWIPPED in industrial.

Cohealo is trying to solve the problem of under-utilized equipment within healthcare systems. The company estimates 58% of hospital equipment is underutilized and 25% is redundant. Cohealo’s solutions foster a collaborative consumption model to better

utilize equipment and reduce costs.

EquipmentShare allows construction companies to share their own equipment. The company also has a telematics solution enabling a user to track mixed fleets and become a fleet owner. It offers construction asset owners the opportunity to “manage, monetize and service assets without lifting a finger.”

KWIPPED began with a model to facilitate equipment rental in contracted industrial equipment. It connects suppliers with users to manage the RFP process and provide short-term rentals typically passed through to the renters’ end customers. Last year, the company added an equipment leasing marketplace for longer-term use cases.

Shared Usage in Equipment Finance

Just as advances in technology are fueling the transformation of assets to a shared platform in both consumer and commercial markets, they are also forcing changes in the financial models supporting them. Unique requirements and challenges exist for commercial shared usage models.

Manufacturers introducing these new technologies frequently face objections to switching costs. However, if new technology can eliminate waste associated with underutilized older technology, the economics start to make sense. Furthermore, if sharing the hardware solution between multiple users or tasks can compound the positive effects of higher utilization, it becomes even more logical for end-users to consider moving from traditional ownership models to shared usage models.

Manufacturers and service providers also derive benefits in bundling hardware, software, services and supplies into usage-based managed services programs, including:

Today, forward thinking manufacturers focus on product strategy roadmaps, which will enable the production of assets better suited for a shared economy model. Some products are geared toward performing a single task for multiple users, such as multiple providers sharing diagnostic equipment in the healthcare industry. Other products are being designed to adapt to multiple tasks, such as multi-tasking robots used in manufacturing facilities to enable more agile small batch production. Regardless of how an asset is ultimately shared, it requires integration of hardware, software and services. An effective product design should be considered the central nervous system in digitizing the user experience.

The future seems rich with opportunity in this shared economy, but challenges must be overcome.

Transforming Data to Knowledge

To harness all this opportunity, the “internet of things” is our new reality. Collecting, managing and translating data from connected devices into pay-per-use subscription plans becomes a critical enabler. Stakeholders in these models rely on connectivity to relay information as to how, when and where assets are being used. The ability to transform this raw data into knowledge, with underlying economic value, emerges at many levels:

According to Cisco, 5 quintillion bytes of data are produced every day. By 2020, the IoT will comprise more than 30 billion connected

devices.

IoT will revolutionize the industrial supply chain in creating operational efficiencies and revenue opportunities.

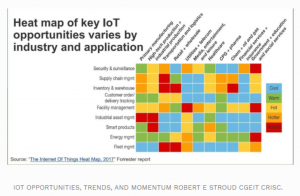

Figure 3, a Forrester heat map, shows the fastest growing areas of IoT adoption by industry and application.

In its current state, less than half of structured data is used in decision making and less than 1% of unstructured data is being tapped. However, over time, data collected will be equal to, if not more valuable than, the device.

Paradigm Shifts

Shared use models represent paradigm shifts for funders and service providers. For funders, the comfort of hell-or-high-water clauses, with minimum commitments on contract terms and payments, would be replaced with variable cash flows. For managed services providers, performance reliability would become more complex as hardware is bundled with services, software and supplies to create comprehensive solutions for end-users. In these new models, service providers and funders become integrally linked in the recovery of asset value.

Manufacturers and service providers, who rely on monetizing existing models to fund working capital, may find it more difficult to find funding sources for pure usage-based models versus fixed-term subscriptions because of potential higher risks in the asset value recovery. Until reliable predictive models catch up with the need to manage these new risks, current funders will be cautious in financing variable usage models which do not include contract minimums.

However, we see pioneers on the horizon in various forms. Essential use takes on new meaning when the value of the data collected can supplement the value of the device by creating diagnostic, customer, market or employee trend reporting. Frequency of use will no longer be the only primary cost recovery metric for an asset. Trail blazers will also extract value from the essential use data as well. A good example is in Amazon’s strategic design for drone delivery services. Amazon is well ahead of other companies in conceptualizing how it will harvest flight data collected from its patented technology to create new profit streams. Aerial data can fill in gaps for aerial mapping companies, provide leads for residential construction and landscaping companies, or even provide valuable repair and preventive maintenance notifications for homeowners. However, without forward-thinking product roadmaps and patent design, much of this data opportunity would be overlooked.

Other operational challenges exist for manufacturers and service providers preparing to look at managed services programs, regardless of the usage model entertained. Preparation requires careful examination of key criteria. A few thought starters can be accessed on The Alta Group’s website.

Sharing economy business models are beginning to gain traction in the B2B equipment space despite the challenges. As IoT, machine learning and software applications continue to converge into product design, We expect a rapid expansion of capabilities and more aggressive adoption of managed services transactions in the form of pure usage models.